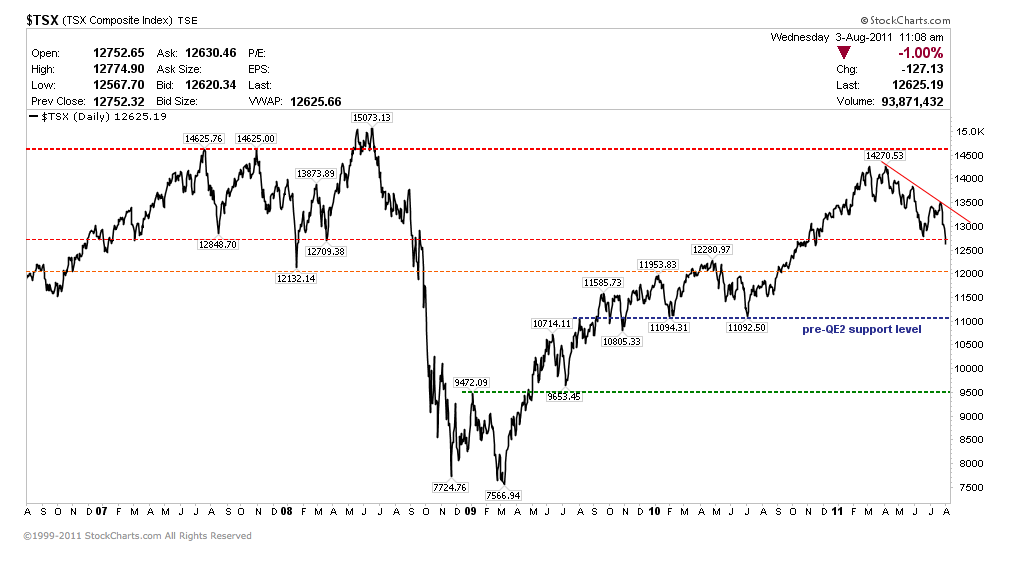

The Canadian TSX is now negative 5.75% for 2011 which means those who are holding have had lots of volatility with no reward and have already given back almost 6% of the QE2 mirage gains made in the last quarter of 2010. Interim rally days are par for the course, but having broken now more than 700 points below long-term support (@13,427), the question to be answered here is where will the index find ultimate support in this cyclical decline? If this is like 2008, it could be much lower as shown below, where the index lost half of its value in 4 short months from July to November.

Nearer-term it seems the 11,000 level that the index rallied from before QE2 seems a reasonable marker. In fact the 11,000 level provided support much further back in the last cycle peaking there in August 2000 (again before losing 50%). If we see a break of 11,000 in the days and weeks ahead, 9500 becomes the next level to watch for support. Beware the long-always advisors and commentators–they will be denying the risks now just as much as they denied them in every other major downturn. Govern your capital accordingly.

Remind Us Again Why Anyone Should Own Stocks For the Next Two Years (August 3, 2011)

http://www.oftwominds.com/blogaug11/stocks-2013-8-11.html

http://video.cnbc.com/gallery/?video=3000036407

I this clip the technical analyst draws a correlation to what happened in 2008. S&P has not broken the range and I think now he would agree we could be in for much further losses. That chart pattern between Jan 2008 and Aug 2008 is almost identical to Jan 2011 until now.

It seems the years and years of having a massive trade deficit (esp with China) looks to be coming to a head. The government is trying to spur private industry to hire but beneath the surface too many goods are being imported into the USA which I think is the real reason jobs are not being created. Until they correct the trade deficit I believe they will continue to struggle. It may indeed be time to raise taxes on imported goods.

i meant to say it has broken the range mentioned in the clip

Can’t thank you enough Danielle for all your efforts to educate us. As I listen to one financial advisor after another saying that now is not the time to be doing anything to your portfolio I feel so sad for everyone who follows that advice. We have been doing our best to follow your advice since 2008 and have been out of any equities for a while. It is so frustrating to have our friends and family losing money even after we have given so many people your book. We think you must be pulling your hair out sometimes. Thanks, we appreciate you so much!