Over the past 12 years as the credit-bubble induced secular bear has continued to grind through the stock market, the potion of choice for many wealthier investors has been to add hedge funds to their portfolio. CNBC likes to call these funds the “smart money.” I call them “hubris funds’ in my book, reflecting the fact that so many of them are full of highly paid MBA’s, CFA’s and PHD’s with lots of confidence and very weak risk management skills. In many cases just when you need them most, their complex strategies turn out to be not hedged at all, but levered and full of losses.

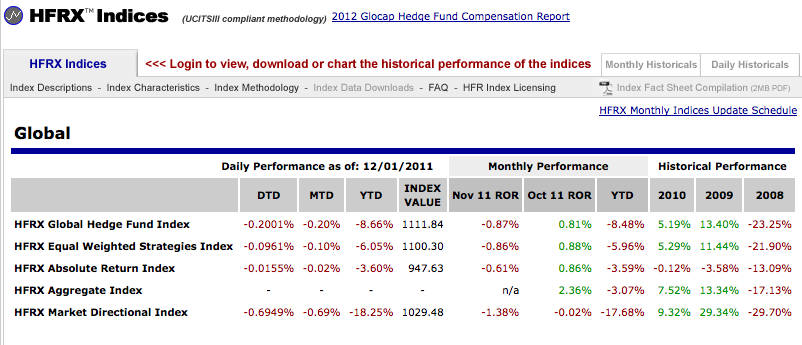

This is not to be too hard on those fiduciaries who are trying their best to honestly execute a discipline and do the right thing for their clients. This has been a very challenging year to date. My firm has positive returns to date, but modest and we are sure-as-hell not feeling cocky in this environment. But numbers tell an enlightening tale about all that hype of “smart money” trading and their talk of always finding attractive things to buy no matter what the macro-climate. Below are some snap shots of their performance, see the whole listing here from the Hedge Fund Research web site. Read ’em and weep.

Hi Danielle,

Glad to hear your firm has returned in the positive this year. Have you indulged in any Gold related investments? It’s gone up solidly again this year and somewhere around 700% for the past ten years – outperforming every asset class… and the DOW.

I know you posted a Kyle Bass video – an in another recent interview (with BBC – ‘Hardtalk’, I think) he did he stated – I’m paraphrasing – “The Fed has printed up 3 trillion dollars out of thin air post 2008 – and the ECB has also printed up 3 trillion (repo market) – why would anyone own paper related assets?” What are your thoughts on this?

Claim: Clinton Collected $50K Per Month From MF Global

http://www.humanevents.com/article.php?id=47938