Poor people and countries suffer most in global recessions. The Economist this month runs with an excellent article on the catalysts for growing unrest in China, some highlights:

“…the explosive growth in the use of home-grown versions of Twitter has made it easy for protestors to convey instant reports and images to huge audiences. The Communist Party’s capacity to stop ripples of unease from widening is waning–just as economic conditions are making trouble more likely.

…Europe is the biggest buyer of Chinese products—and the euro zone’s travails have plunged many [Chinese] manufacturers into despair. Depressed demand in both Europe and America has taken its toll on factories. The steelworkers’ strike was one of many in recent months, most of them in China’s export-manufacturing heartlands near the coast…this time exporters face protracted slow growth in developed economies, and the risk that the euro zone’s difficulties might worsen. China’s policymakers do not want another lending spree that might burden the financial system with more bad debt, on top of the borrowing accumulated during the previous binge.”

See: Unrest in China, a dangerous year

This chart of Chinese Money Supply shows the massive liquidity expansion from the 4 trillion yuan ($630 billion) stimulus package the Chinese unleashed against the last global recession in 2008 followed by the equally extreme plunge in the money supply since–now at a 10 year low.

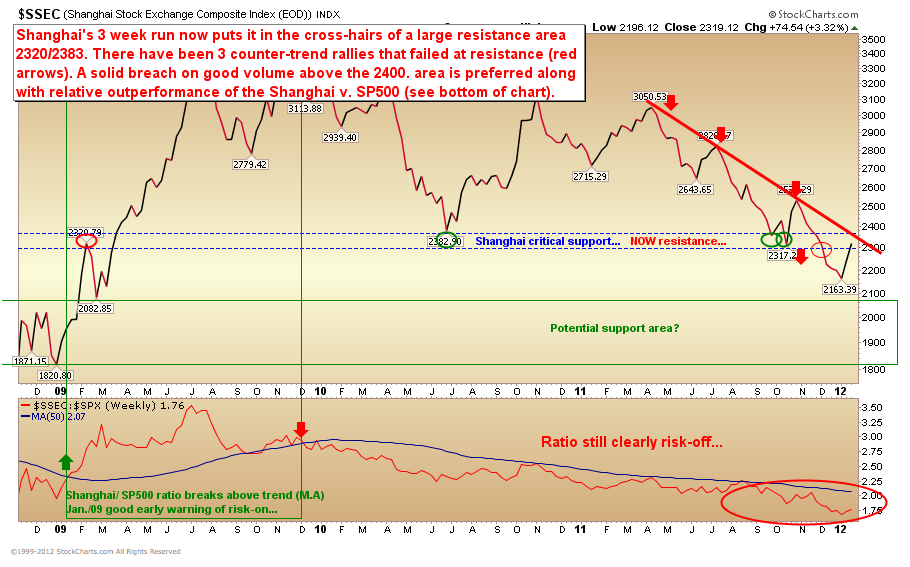

This also confirms what the Chinese stock market has been telling us for many months now–the longer-term trend has been down since last April. The nearer the Shanghai moves toward its November 2008 lows, the lower it beckons other lagging world stock and commodity markets to follow.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Imagine what a full-blown real estate collapse would do to that money supply.

Those Chinese may have actually topped out for good. The demographics going forward don’t tell a pretty story. Maybe war is their only salvation. The Chinese are putting an awful lot of Wal-Mart profits into the military build-up these days.

Maybe thats the real reason for having so many boy babies over there. Military service to get them out of the country, since there aren’t enough females to make families with. China makes us look smarter by the day, actually.

Good interview with Mike Shedlock

http://rt.com/programs/capital-account/capital-11912-money-federal/

Agree…..China, the accident waiting to happen. Better yet during a business trip in Western Michigan around 2005, I met a Chinese business man trying to sell automotive parts to us at Magna. When the topic of pricing came up, everyone was shocked. Chinese parts were at the time 50% below our cost! When pressed our Chinese business man admitted that his factory was government financed, with loans that did not have to be repaid. NICE, free money! China has invested in massive over capacity, fueled by cheap money. This is going to end very BADLY. The crash is going to be biblical!