Some articles today worth considering:

- Deleveraging will take over as everyone runs out of ammunition

- Lacy Hunt on The roadblock to recovery

- ECRI recession call: growth index contraction eases (good charts)

Pimco’s Mohamed El- Erian on this morning’s stronger than forecast employment report. Risk on for how long? Here is the video link.

Meanwhile, there is further evidence this morning that Eurozone growth recessed in the fourth quarter and retail sales dropped 0.4 per cent during January, foiling expectations for an increase.

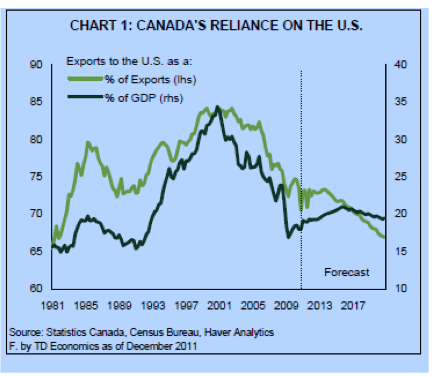

In addition, on top of another month of negative GDP growth in Canada for November, this morning we learned that Canada produced just 2300 jobs last month and the unemployment rate moved up to 7.6%. Not to worry, only 70% of Canada’s exports go to the US today (down from 85% in 2002, see chart below) I am sure Canada will fare just fine if the US economy continues to flat line for a few years here. (yes, sorry, a little sarcasm…)

Of course, none of this is bothering stock markets today…today they dance, drink and be merry. Those who are sober will have to wait for another day for facts to be faced in the global economy it seems. On the other hand if all is well in the world, why would we need QE3, oops what do you mean you traders already priced it in?

What is it about the maxim, “Don’t fight the Fed,” that people don’t understand?

IT’S ONLY $700 TRILLION – WHAT COULD POSSIBLY GO WRONG?

http://www.theburningplatform.com/?p=28801

I think the europe thing will be worked out which will send this market even higher

After watching the El-Erian video I figure his “short term risk on” trade means he probably went risk off on Friday.

Richard

The part where the Fed is not actually capable of supporting or controlling the global system. This is narrative fallacy in the extreme. Hence why history shows a series of bear markets where equities lose half their value in a matter of months notwithstanding the Fed and their magical tricks. “Don’t fight the Fed” is the perma-bulls’ excuse for not taking care of capital. Particularly when stocks and earnings are overvalued like today, it is the rally cry of the reckless, irresponsible and the foolish.

Excellent commentary in the posted links. Markets are getting goosed by liquidity and suspicious statistics re. employment data.

It’s hard sitting in cash folks but you’ll feel a lot worse if you invest your hard earned capital today only to see it vanish in a BANG moment.

Bernanke hasn’t gotten anything fixed or right since he got promoted to the job. As long as we have ZIRP…its ZIP to the cash-holding oldsters who are really going to need every penny of it in the Coming Inflation of Necessities. How many old people do you see chatting on an I-phone? They tend to be strung out on IHOPs.

Don’t worry, its early February and the money flow dries up soon. AND February is a notoriously bad month for the markets, second only to September. All you cash holders, keep your powder very, very dry. This is a bull trap.