Up close it may seem that US bond yields have backed up a lot over the past 5 weeks. As the ECB has floundered to find consensus for the next bank bailout scheme, all hopes have turned back to the US Fed and its upcoming meetings on August 31 and Sept 12. Will they or won’t they plunder the coffers once more and flood further infertile cash into the already cash-swamped banking system?

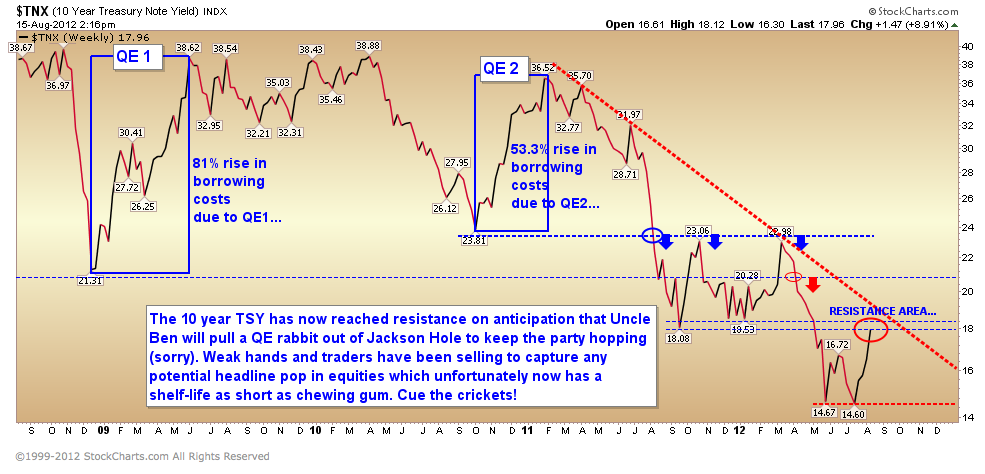

Big picture, even with the recent move higher in yields, as shown in the chart below, 10 year US yields remain well below overhead resistance in the 1.8–1.90 range and may now have already priced in the idea of further Fed easing announcements. Recall the Fed’s assertion that they roll out easing in an effort to lower rates? Except that every time they do rates have only defied this object and moved higher–thereby increasing–not decreasing carrying costs for consumers.

This puts the economy in a lose-lose situation–further QE has already been priced into not just stocks but also bonds and key consumer commodities like oil and food. The latter two are placing unwanted additional stress on the already weak consumer-dependent US economy. More QE is only likely to further extenuate the downturn in demand already underway.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

And one more huge negative of the “zero-rate” policies celebrated by central bankers. As shown in the chart below, zero bound rates do not spur consumption- they force dramatically increased savings for consumers. At today’s savagely suppressed rates, workers must set aside more than 20% of their annual income in order to amass the same nest egg as they would have built with just a 5% savings rate were deposit interest rates in a more normal 5-6% range. At the same time, retirees today are receiving much less income from their savings and so they too have much less to spend in the real economy. With governments hacking their budgets, and consumers scrimping for pennies, this is setting up to be one mother of a global downturn.

Well, then there’s good news. The 31 year bull market in government bonds has finally ended in june/july of this year. Rates now only have one way to go: Higher !!!

No, rates are NOT going higher because of Inflation but because of fear of default of the US.

Contrary to common believe, rising rates are NOT Inflationary but they are Deflationary. Inflation is the situation where the value of money decreases against e.g. T-bonds, a.k.a. falling interest rates. Deflation is the situation where the value of money increases against e.g. T-bonds (rising interest rates).

Never read Robert Prechter’s “Conquer the Crash” ???

From what I’ve seen, interest rates and price inflation are generally correlated historically, though not perfectly.

Monetary inflation, such as that produced by central bank monetization of government debt, is but one factor of many in determining price inflation. Ultimately, price inflation depends on relative rates of change in supply and demand for any good or service, regardless of the money supply (witness housing in the US). Increasing the money supply relative to overall available goods and services is one way to increase aggregate demand if the increased supply also results in increased velocity. In other words, governments and central banks can create the money, but if the people don’t want it, there won’t be a proportional increase in prices.

Ultimately, the issue for retirees and those who plan to retire at some point is not nominal interest rates. It’s the purchasing power of their money. If rates drop, but the purchasing power of money remains stable or drops at a proportionally lower rate in line with interest rates, then more retirement savings will not be required. The biggest reason people need higher rates is to offset the loss of purchasing power (eg. the dollar you save today will only be worth, say, “50 cents” in 20 years).

In fact, high interest rates can actually be harmful because they typically occur during periods of high inflation. While higher inflation will erode the purchasing of your money faster, the return you get on an investment paying a high interest rate will result in higher taxes paid, because your nominal gain (which is all the government cares about) is higher, even though your real gain may not be higher if compared to a low rate/low inflation environment. It’s a double whammy to your wealth. It’s called the “inflation tax” and it’s why an inflation-correlated asset (e.g. arguably gold bullion), that only gives you a capital gain can actually generate an after-tax loss the higher inflation, and thus the higher the asset price, gets.

When the US had a more stable, gold-backed dollar, price inflation was not a problem. In fact, during the US’s large economic expansion in the 19th century, mild deflation, caused by higher productivity, was the norm. Back then a saver could feel confident that the dollar he socked away would buy roughly the same goods ands services 30 years later (maybe even more). The era of high inflation, as we’ve all become inured to, really only took hold in the late ‘60s when the US ran up large deficits to pay for the Vietnam War, which later caused America to default on its obligations by delinking the dollar from gold, as stipulated under Bretton Woods.