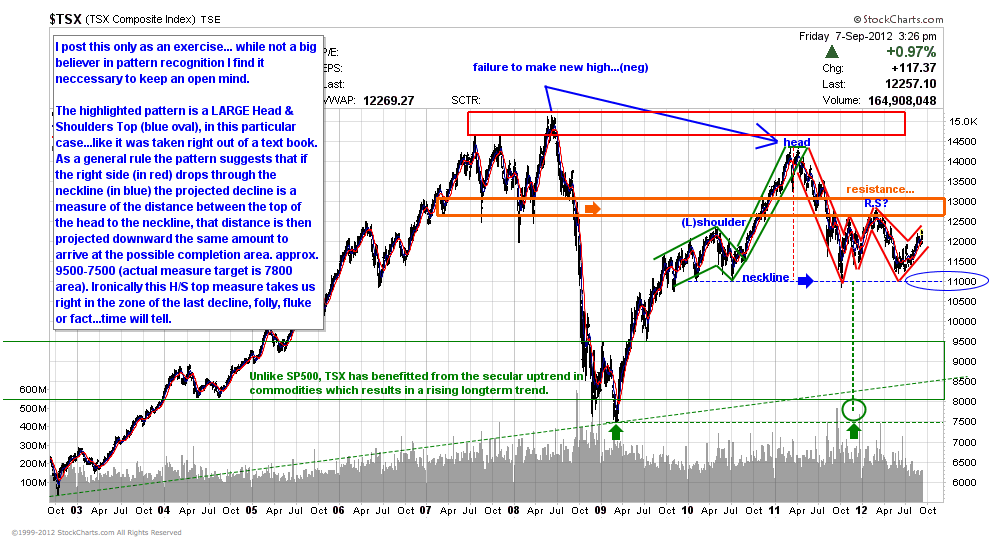

Big picture charts offer some helpful perspective on where we are at after the wild jolts of taxpayer-funded capital injections the past few years. Canada–hardware store to a world where 82% of manufacturing data is now contracting–continues to look weak and vulnerable. We can also look forward to a more normal cyclical recovery in stocks (note the slower, steady price action from the bottom in 2002-03 until the credit mess blew in 2006) one day once central banks stop flooding and let slow demand find its own organic level.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Follow

____________________________

Cory’s Chart Corner

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In