Some high profile analysts and strategists have been publicly admitting their surprise this week that “defensive” income equities have been falling along with other sectors during the latest wave of this ongoing stock market correction. It is common for long-always firms to delude themselves and their clients into believing that dividend paying stocks are defensive during cyclical bears within secular bears. But market history assures us otherwise. There are a few key reasons for this:

- the low rate environment has pushed many people into dividend paying instruments at lofty prices because they are desperately reaching for yield. As this buying pressure abates, prices fall as defensive investors panic and sell.

- the income trade is also heavily populated today by algos and other levered traders who are only there for the apparent liquidity and hope of a quick buck. Once prices start to decline, they sell faster than the longer-term income investors can blink. As prices move down, this creates a cascade effect in waves of selling.

- Contrary to the complacent naive views of many holders, dividends are not permanent or etched in stone. Dividends are at the discretion of management and can only be paid out of retained earnings and net income. Companies can, should, and do reduce and suspend dividends when they enter a period of significant financial uncertainty or liquidity stress. Once dividend expectations are disappointed, then holders are left with the near certain prospect of capital losses since both long term investors and short term traders are quick to sell on the (always unexpected!) news. The higher the price when the company disappoints, the greater the downside risk to capital.

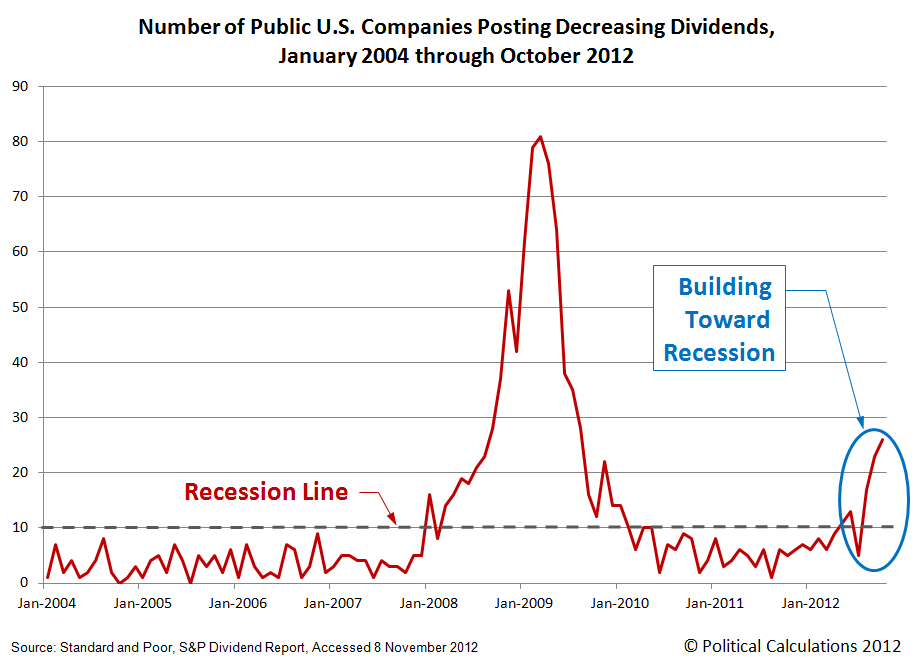

This article explains dividend disappointment trends as a leading indicator for recession, and points out that the US likely entered recession in the early summer of 2012.

“In October 2012, S&P recorded that some 2,471 publicly-traded companies making declarations regarding their dividends, with 165 announcing dividend increases and 26 announcing they would cut their dividends. To put that level of dividend cuts for the month of October 2012 into context…

If we then set the value of ten companies per month that act to cut their dividends as the threshold at which a recession in the U.S. is likely to exist, we find that the U.S. economy first dipped into recessionary territory in May 2012, exited briefly in July 2012, and re-entered more deeply into that recessionary territory again in August, going deeper in each month since.

So no matter what you might hear in the mainstream media or from the White House, this isn’t a situation that developed overnight because of the aftermath of Hurricane Sandy or the so-called “fiscal cliff”. Recessionary forces have been at work in the U.S. economy for many months now….”

This is the result of enlightened Liberal or Progressive government policies wherein government spends massively more than it takes in on unsustainable social programs. What makes makes people believe that politicians some who have been elected right out of college are qualified to set prices such as interest rates which are properly set by the market? Has central planning ever produced wealth and security for “working people”?

However buying some large CAPS when they are cheap, and with a history of raising their dividends during good times and bad, will serve you well in the long run.

At least this has worked for me during the past 30 years.

Pipelines, utilities, CN Rail, Mcdonalds and our banks (never resource stocks or gold) have been spectacular performers for my (rising) income oriented portfolio. And the CDN banks were in rougher shape in the mid eighties than in 2008. I remember that quite clearly.

My poor heirs will have a LOT of capital gains to pay when I pass on – but that’s their “problem”

“all this has worked for me in the past 30 years”….

Yeah, you have gotten the wind at your back with all those baby-boomers working, saving, investing, spending etc. Now they are exiting. Good Luck with the ‘next 30 years’…. say have you ever tried sailing? Its pretty rough when tailwinds turn into headwinds….its not as fun.

OBTW: Doctors will be needed in droves due to aging boomers and ObamaCare freebie-expecters….and expect to wait a long time to be seen by those not-yet-trained doctors….(it takes YEARS of training don’t forget, unlike a ‘trader’…hee hee)

Utilities are traditionally among the highest dividend paying stocks. Yet the DJ Utilities Average plunged 60% in the 2000-2002 bear market, considerably more than the 50% decline of the S&P 500. And it plunged 48% in the 2007-2009 bear market, not much different than the 50% decline of the S&P 500.

Has central planning ever produced wealth and security for working people? “Central planning”, or more specifically, government participation in the economy can certainly facilitate wealth creation. The mere existence of an adequate social safety net gives people the confidence to consume and take investment risks that they may not otherwise have done. Contrast this with China where they are desperate to decrease dependence on exports and increase internal consumption, but because people have to maintain a very high savings rate to guard against emergency contingencies given their paltry safety net, this is proving extremely difficult.

There are countless other examples of beneficial intervention such as enacting and enforcing reasonable regulations that give people the confidence to invest and consume, etc. Of course misguided or excessive “central planning”/intervention can be counterproductive, but none at all as you seem to be advocating is definitely counterproductive. The trick is finding an optimal sustainable balance. It is especially difficult given that politicians want to get re-elected and are also tempted by the corrupting influence of rich and powerful vested interests.

Our social safety net is a mirage as we are likely to find out. A job is the only meaningful “adequate social safety net” and it is government policies that have driven us to the brink and I believe over. You said it, “It is especially difficult given that politicians want to get re-elected and are also tempted by the corrupting influence of rich and powerful vested interests”. Politicians almost total financial and economic illiteracy along with the fact most politicians are by and large not successful entrepreneurs and capable managers disqualifies them from interfering in the running of every business in the country. If government stuck to their basic responsibilities such as foreign relations, defence, and public safety we would be in much better shape. Government regulations are much like prescription drugs, if you take one then you often have to take another to counter deleterious or adverse side effects which may lead to other side effects. Less regulation and more use of the legal system may be more effective in enforcing honesty and good judgement in business instead of suffocating businesses under red tape and heavy taxes supporting non productive government regulatory agencies.

Regarding your remark that “it is government policies that have driven us to the brink”… For the most part government is a civilizing force and a necessary evil which is tolerated in order to enact and enforce rules to protect individuals and society from predators, including economic predators. Your suggestion about less government regulation and more reliance on the legal system to enforce honesty has some significant practical limitations including the fact that aggrieved plaintiffs in civil actions may not be able to compete with the enormous financial resources of some of these predators. Similarly, in criminal actions, prosecutors with heavy caseloads may not always have the time and resources (especially if funds are cut back as you wish) to prosecute effectively against predators with deep pockets who can afford to put up all kinds of legal obstacles. Moreover, it is imprudent to depend on the legal system to always do the right thing if history is any indication, just consider the recent Citizens United decision in the US, not to mention other more atrocious decision such as Dred Scott etc. Consequently, we cannot do without reasonable rules and regulations in addition to the legal option.

Your suggestion that government get out of the economic arena and “stick to their basic responsibilities such as foreign relations, defence, and public safety” is not realistic. Laissez faire has already been tried, refer to the 19th century. It ended up becoming so counterproductive that even Teddy Roosevelt, who was not exactly a socialist, felt compelled to introduce meaningful reforms and regulations. And his main impetus was not even fear of revolution by the “proletariat” but rather complaints from major capitalists that the monopolistic gouging from the upper tier capitalists (robber barons) such as Rockefeller and Carnegie, had become so egregious that it went against their interests and the broader national interest. Incidentally, one of the longest economic depressions on record (from 1873 to 1896) occurred during the laissez faire era. So much for the quick self-correcting nature of laissez faire economies.

Finally, the social safety net is hardly a mirage although its generosity will obviously be limited or scaled back in light of years of irresponsible budgetary management. You are right that a job is the best social safety net, but unfortunately economies, especially laissez faire ones, are volatile and periodically produce (sometimes lengthy) periods of significantly increased unemployment. Failing to mitigate or dampen this volatility through prudent countercyclical government intervention as Keynes advocated is a recipe for social upheaval. Unfortunately in practice politicians have been irresponsible by not raising revenues during good times in order to finance the interventions during the bad times. Ideally, citizens/voters should keep themselves informed and be engaged in order to hold politicians accountable. Unfortunately, many prefer frivolous diversions such as sitcoms and football games, etc. And many others have not cultivated the critical judgment to see through the constant barrage of propaganda from well funded vested interests that distort many of the important issues. (Fox News comes to mind.)

PS: Your notion that politicians are incompetent financial managers because they do not have entrepreneurial experience is a somewhat specious argument. Entrepreneurial experience would be helpful but they can easily surround themselves with experienced and competent businessmen advisors. Their incompetence/irresponsibility is systemic; mainly as a result of their need to get re-elected and the corrupting influence of rich and powerful vested interests, as I mentioned initially.