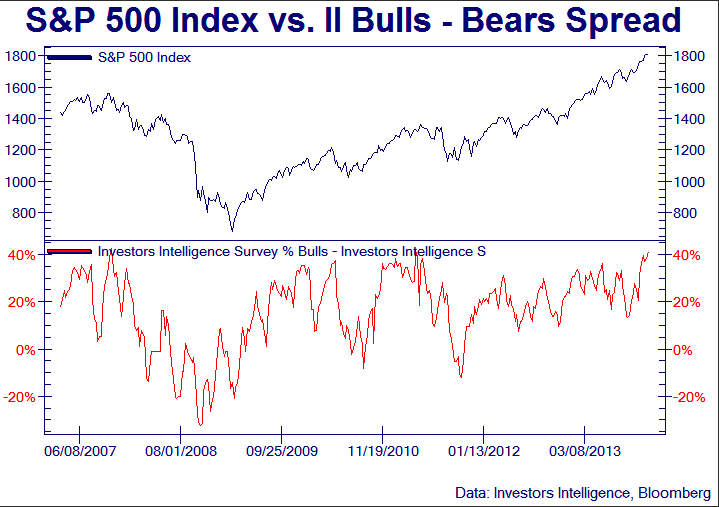

Further to my Relentless rally chasing bears to near extinction, comes this big picture chart showing today’s equity bulls over bears spread back where it was at the last deluded market peak in 2007. See also this good overview of more bubbly indicators: Fantasy stocks for a fantasy market.

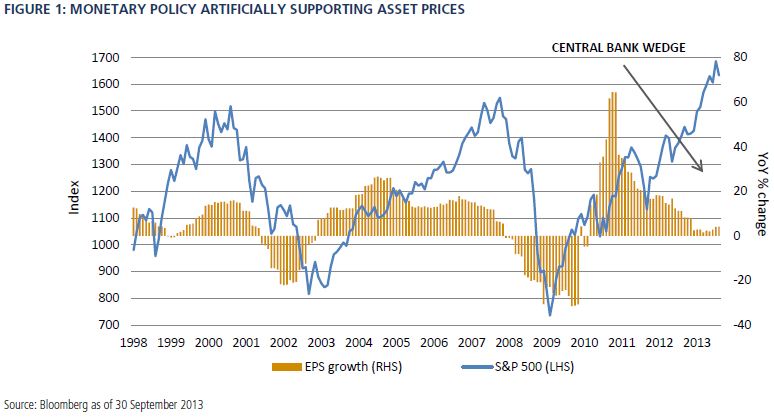

Meanwhile corporate earnings, that had achieved unprecedented levels (70% above historic norms) coming out of the lean cost structures of the 2008 Recession (See Big holes in bullish case), have been steadily losing steam as shown in this next chart below courtesy of Pimco this week graphing the S&P price on top versus S&P earnings growth (or near lack there of over the past year)on the bottom.

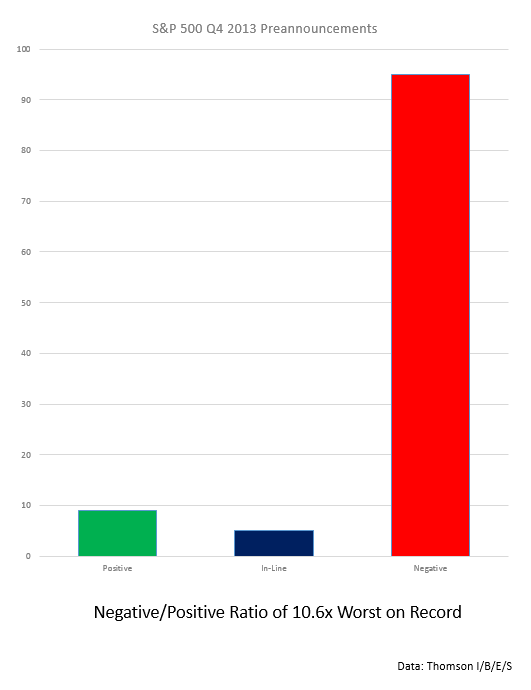

And as for all the talk about a big rebound in 4th quarter earnings? So far corporations have pre-announced negative to positive outlook changes 10.6 to 1 as shown below. But then maybe the bulls are right: who needs earnings or customers, when markets have the Fed? Party on Garth!