Quite a sight this morning to see Mr. Carney, former Bank of Canada head, now leading the Bank of England, announcing new policies he says are designed to help financial instability risks building from over-valued housing and high household debt levels in the UK. Here is a direct video link.

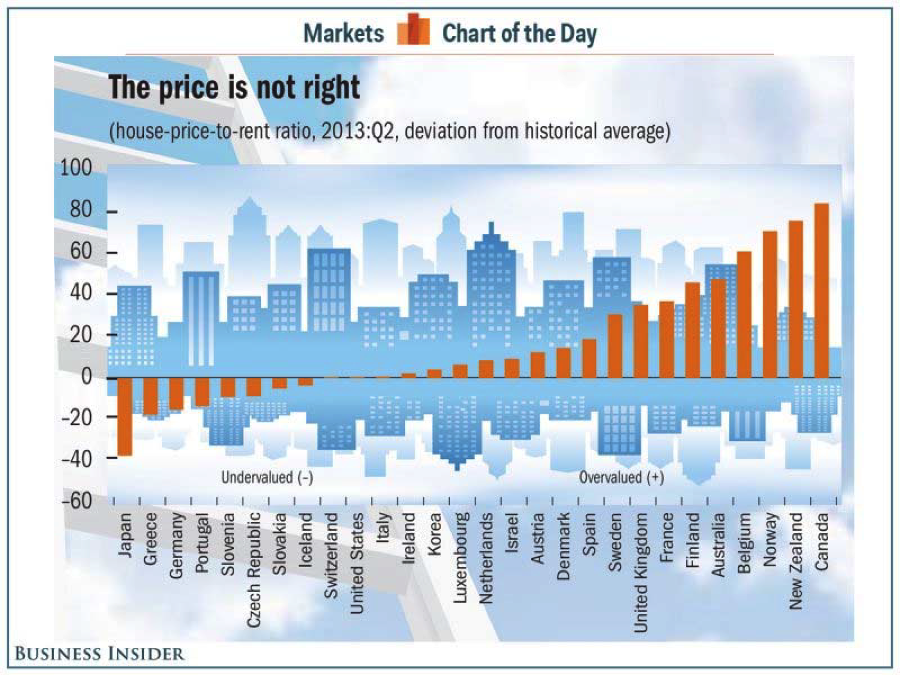

Better late than never to be sure. But as all ears hang on Mr. Carney’s eloquent words and educated assurances, there is some irony to be found in the below big picture chart showing that ultra-loose monetary policies the past 5 years (which were led by Mr. Carney) have left Canada today with the most over-valued home prices in the world. Hand in hand of course, with the most indebted households.

As Mr Carney explains in the clip, studies have shown that when home prices ultimately correct from over-valued periods “you end up with a recession that is much deeper…recessions associated with housing crashes are about 3x as deep as average recessions.” So as commodity prices continue to slump amid a sea of over-supply and weak global demand, the Canadian economy is the least prepared to absorb the downturn than it has been in least a couple of decades. Too bad policy makers and bankers are so adept at closing stables long after horses have run wild. I look forward to the day when the most dominant news stories are no longer about the ‘brilliance’ of central bankers.

Follow

____________________________

Cory’s Chart Corner

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In