78% of NFL player, 60% of NBA players go bankrupt within 5 years of retirement. The reasons are typical human behavior: sudden big wealth is overspent, wasted and mismanaged by the players themselves and their spouses, and by the self-focused financial “advisers” brought in to mangle manage the money. See: Five reasons professional athletes go bankrupt.

Eugene Lee, CEO at ETL Associates, discusses the personal economics of NFL players from an agent’s perspective. Here is a direct video link.

Agent Lee: “We have a duty to align our clients with the right financial advisers.”

With 3/4’s going broke: easy to say, hard to do. Clearly.

Financial success over a lifetime is a marathon of personal discipline.

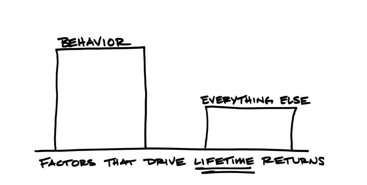

It requires advisers and managers that are willing to do the right thing and offer the right advice for the client (the opposite of investment salesmanship) even when it is not sexy or popular, and clients who wish to hear and adhere to disciplined advice year in and year out without getting seduced or distracted by shiny things and fast talkers. Hence the financial failure rate is very high across all walks of life. The above graphic from Behaviorgap.com says it all.

It requires advisers and managers that are willing to do the right thing and offer the right advice for the client (the opposite of investment salesmanship) even when it is not sexy or popular, and clients who wish to hear and adhere to disciplined advice year in and year out without getting seduced or distracted by shiny things and fast talkers. Hence the financial failure rate is very high across all walks of life. The above graphic from Behaviorgap.com says it all.