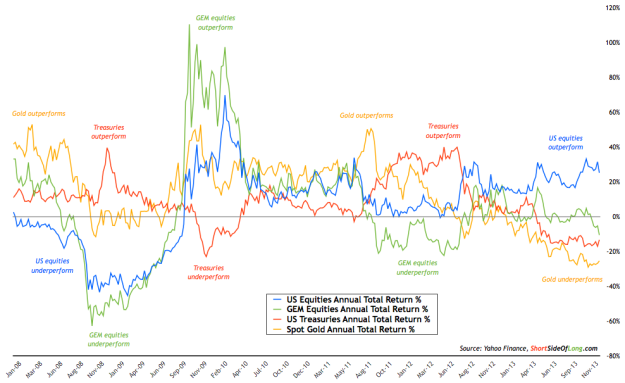

There is no doubt that some major developed ecomomies saw stellar equity gains in 2013. But careful risk management does not place all capital eggs in one asset type, and as shown in the chart below, most other asset classes–like emerging markets, precious metals, commodities, bonds, non-US currencies and alternative funds–mostly lost money over the last 12 months. Some lost a lot.

Infact overall in diversified portfolios, huge gains made on developed market equities were not enough to outweigh the losses in the other asset classes, making portfolio returns for many investors negative to flat on the year–notwithstanding tons of capital risk and all the QE-hype in the world.

Of course, those who were heavily concentrated in US equities and Canadian banks in 2013, with little to no exposure to other asset classes, showed high double digit returns on the year (although not over the past 5 or 14 years as most were really just making back the money they lost in the 2000 and 2008 bear markets, but who wants to fuss over math?).

The trouble is that those same “winners” from 2013 now find their net worth (and worse, their borrowed margin accounts) precariously perched once more near the summit of the most over-valued assets in the world coming into 2014. And the plan is????