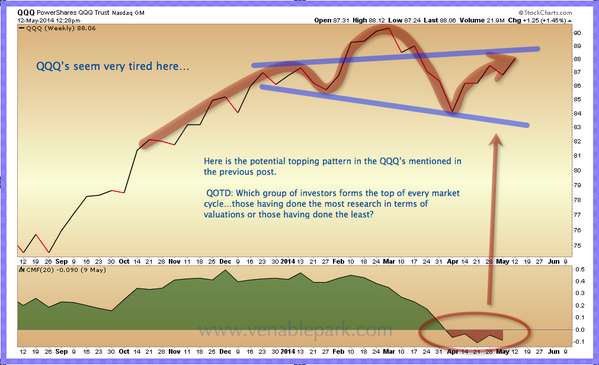

With tech and small cap shares down heavily the past few weeks, today many are staging a classic counter-trend rally on vapid volume. Its important to keep in mind however, that no matter what financial sales people tell us, regaining some losses is not the same as making money. This chart of the NASDAQ offers perspective, with volume shown in orange at bottom.

Lance Roberts offers a similar appraisal here, see: Is the market consolidating or topping?

While it is certainly possible that the markets could ratchet higher from here due to the “psychological momentum” that currently exists, the likelihood of a runaway bull market from here is remote. What history tells us is that when markets are attaining new highs, the end of a particular bull market cycle is closer than the beginning. It is also worthwhile to remember that getting back to even is NOT an investment strategy.

It is easy to get lured into the casino as the flashing lights and cries of barkers send out the siren’s call that “everyone’s a winner.” However, the difference between a successful gambler and everyone else is knowing that “hot hands” eventually run cold. Knowing when to walk away from the table is what separates success from failure. In both cases, by the time a winning streak gets you back to even, it has generally run the majority of its course. As Nick Dandalos once said:

“The house doesn’t beat the player. It just gives him the opportunity to beat himself.”