Good discussion of current market conditions. Carter Worth, chief market technician at Sterne Agee, says the stall in the U.S. stock market “foreshadows trouble ahead” because the technicals are “not good.” Here is a direct video link.

We agree with Worth that the present period has little to liken itself to 1994. Some of the important differences in our view:

- 1994 was year 12 of a secular bull market (1982 to 2000). 2014 is year 14 of a secular bear market (2000 to 2017??).

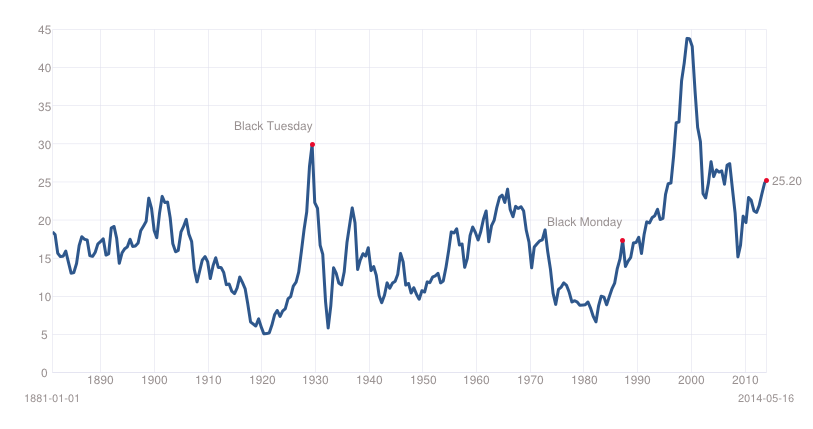

- stock valuations (Shiller PE) in 1994 were less than 20 versus more than 25 today.

- in 1994 the leading edge of the baby boomers were 48 and just coming into their peak spending years. In 2014, the leading edge boomers are 68 and firmly into downsizing mode.

- US GDP annual growth rates were averaging 3.6% in 1994, today they are averaging less than 2%.

- in 1994 US households average debt to GDP was at 60%, compared with today more than 80% in the US and more than 90% in Canada.

- in 1994, home prices had been relatively flat for more than a decade and most families had positive equity. Today home prices remain at relatively high valuations in most areas and more than 20% of owners owe more than their home is worth.

- in 1994 20 and 30-somethings were coming into the work force with little to no personal debt, today they are heavily encumbered with consumer and student loans.

- in 1994 the average household savings rate was above 7%, today it is below 4%

- in 1994, the executives of public corporations had not yet reached the zenith of God-complex, and were then extracting an average income of 90 x the average worker versus the garish and destructive 300x the average worker’s pay today.

- in 1994 taxation rates, regulation and interest rates had all been higher and were in the midst of a major move lower from 1982 to 2007. Having hit generational lows leading up to the 2008 crisis, these key policy areas are all necessarily in a multi-year process of mean reverting higher.

- in 1994 the Central Banks had relative strength with modest “normal” balance sheets, today they have already blown their fire power having swapped liquidity for trillions of lower quality debts from investment banks via QE.