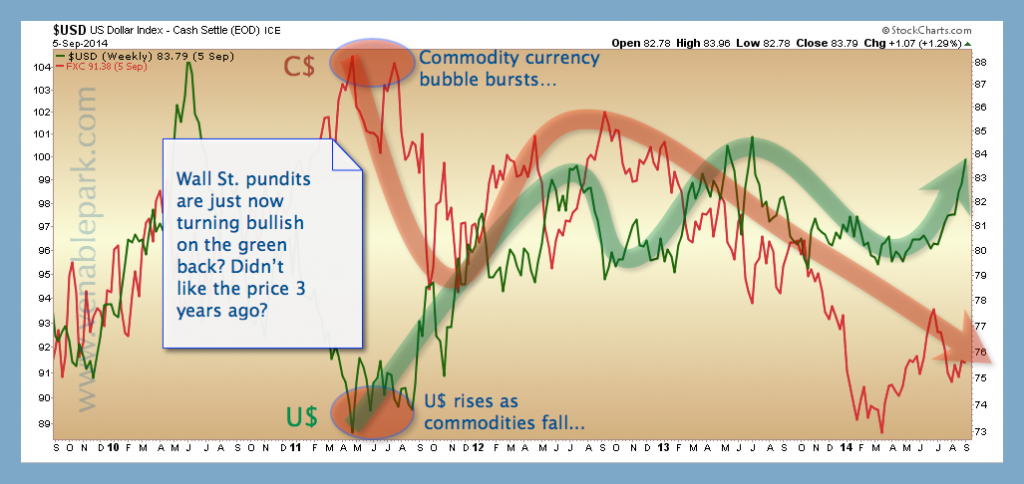

When the US dollar was carving out a double bottom in 2011 and the Canadian dollar was rebounding along with QE hopes for an extended commodity’s boom, the greenback was widely declared doomed. In fact strategists were pretty unanimously bearish on the U$ while bullish on the loonie/commodities/precious metals. At our firm, our analysis led us to a polar opposite view.

Three and half years later, the U$ continues to rally as the loonie has weakened and commodities languish. The chart below shows the U$ in green and the C$ in orange since 2009. In recent weeks, we note the same trend-following strategists beginning to pen bullish forecasts on the U$. We take no comfort in consensus views (as they are often nothing more than mindless extrapolations of past into future), but currency cycles tend to be 7-10 years, and many aspects of our analysis suggest that this one probably has further to run.

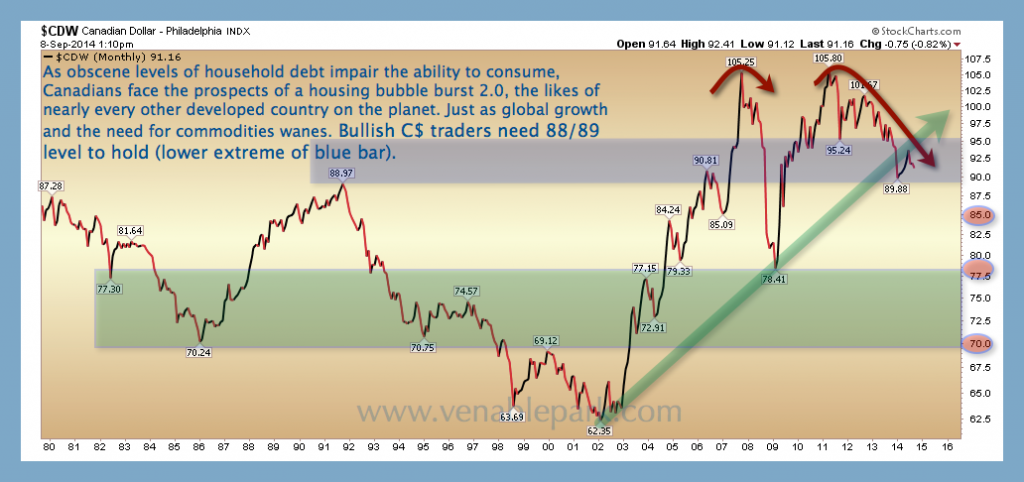

More interesting is this next longer-term view of the Canadian dollar since 1980. The green arrow marks its 6-year surge with the commodities super cycle from 2002 to 2008, breakdown with the credit burst into 2009, rally on QE faith into 2011, and the steady leak lower ever since. In 2014, we can see that the 2002-2011 cycle support (far right arrow) that proved downside support in the ’08-’09 sell-off has now broken. This suggests that mean-reversion back below .80 is a reasonable target ahead.

More interesting is this next longer-term view of the Canadian dollar since 1980. The green arrow marks its 6-year surge with the commodities super cycle from 2002 to 2008, breakdown with the credit burst into 2009, rally on QE faith into 2011, and the steady leak lower ever since. In 2014, we can see that the 2002-2011 cycle support (far right arrow) that proved downside support in the ’08-’09 sell-off has now broken. This suggests that mean-reversion back below .80 is a reasonable target ahead.