Remember in the spring of 2007 when credit and stock markets were priced for perfection, volatility was at record lows, complacency at record highs, and the consensus felt confident good times would continue?

Benefit Street Partners President Richard Byrne discusses bond and credit market risks being today higher than the bubble peak in 2007. Here is a direct video link.

Important to note: repeatedly borrowing money in order to be able to make the payments on the funds you have previously borrowed, has been the strategy of many high yield companies (especially in energy) this cycle, as interest rates moved lower. It is also otherwise known as a Ponzi scheme.

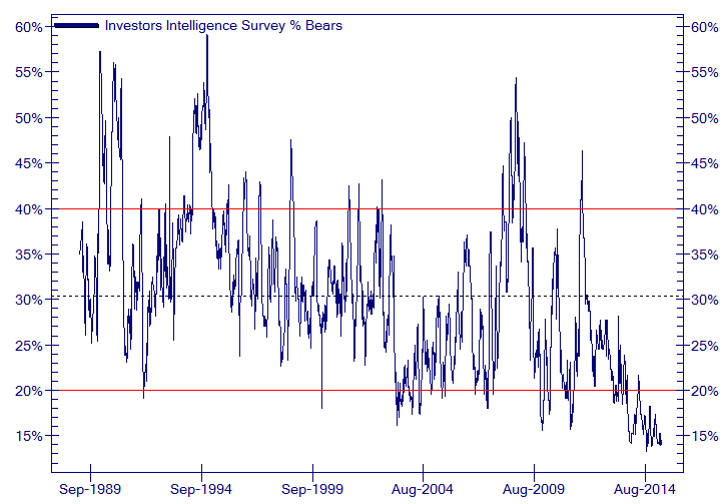

Actually as shown here, (courtesy of NotJimCramer.com) at 13.9%, bearish sentiment is lower today than the fast-asleep-before-the-Great-Financial-Crisis lows in 2007. Amazing how short the human memory can be.