A 2013 study by the US Government Accountability Office (GAO) released yesterday, confirms the dilapidated finances of most American households (still considered the relatively wealthiest population in the world mind you). See: Most Households approaching retirement have low savings.

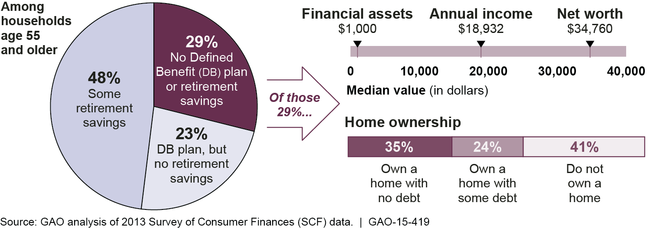

- Half of households age 55 and older have no retirement savings (such as in a 401(k) plan or an IRA).

- Many older households without retirement savings have few other resources, such as a defined benefit (DB) plan or non-retirement savings, to draw on in retirement (see figure below).

- Among those with some retirement savings, the median amount of those savings is $104,000 for households aged 55-64 and $148,000 for households aged 65-74.

- This level of savings will produce approximately $310 and $649 per month of retirement savings respectively, in an inflation-protected annuity at current rates.

- Social Security provides most of the income for about half of households age 65 and older.

But not to worry, because in related news: financial salesman extraordinaire, JP Morgan CEO and Chairman and former Citgroup executive, Jamie Dimon is a billionaire at last!

Yes, successive, taxpayer-funded, bank bailout beneficiary Jamie, has proven yet again, that the best way to get rich is to run a big bank and repeatedly blow it up. You implode and confiscate the capital entrusted to you by all the little people of course, but in the process you make yourself ultra-rich and widely revered for all your ‘richness’. Good going Jamie. You are a wonder.

For an excellent summary of the long list of illegal (and highly profitable activities) that JP Morgan has admitted to conducting while Jamie has been its chief, see: How Jamie Dimon became a billionaire.