With the media hyperbolizing the recent market “bloodbath”, it’s good to have a sense of humor and a sense of history.

This morning the usual ‘long-always’ financial types–who never, ever talk about investors taking advantage of selling opportunities when prices are high–are all peddling their usual snake oil about “buying opportunities” as knives fall. People who care about protecting capital need to maintain sober thinking.

As charted below, the drops in commodities and North American government bond yields have been screaming about plunging global growth and over-optimistic stock and high yield debt markets for well over 2 years, as policy leaders and HFT traders have worked to lure savings into harm’s way with confidence pumps and trickery.

In the process, the global economy and its risk markets are more indebted, precariously over-valued and vulnerable to capital losses today, than at the now infamous tops of 2007 or 1929. Oil and other commodity markets already ‘read the memo’ and over the past year, gave up all pretense of global recovery. With oil (WTIC in olive below) today at its 2009 recession low and copper (brown below) round tripping, the ‘carnage’ in stock markets like the S&P 500 (see in red below) has been relatively laughable to date.

Even after dramatic drops this past week, the S&P 500 has some 38% to fall just to give back the QE3-overshoot that began in October 2011. And that could be perhaps half way down to its bouncing place this cycle (marked with blue circle far right above). One can imagine the expletives and pessimism that will be emanating from present bulls then.

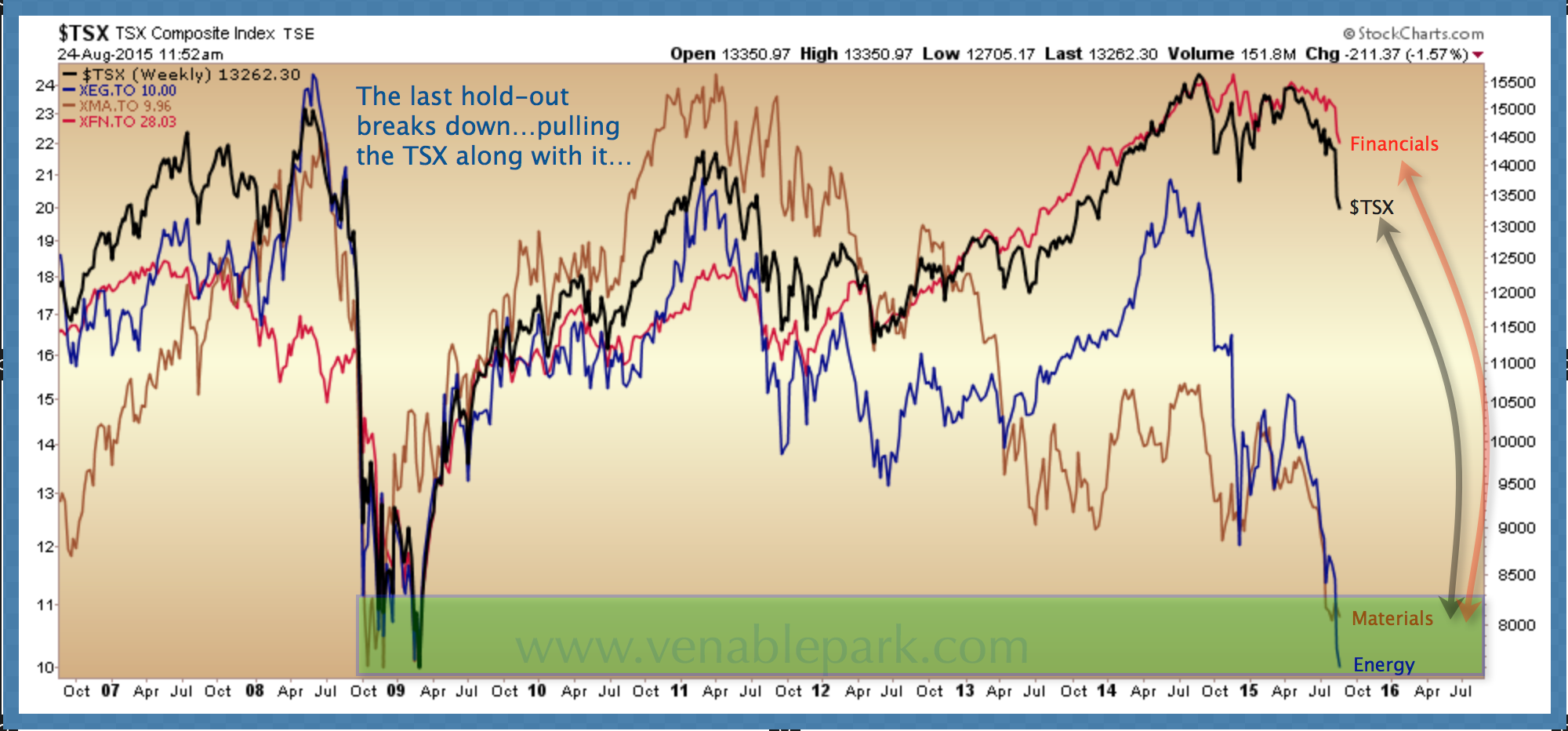

With the resource sector having already given up the QE dream, the Canadian TSX (in black below) has accomplished more downside work than the S&P 500 to date, but still levitates on deluded valuations in the Canadian real estate and finance sector (in red below). Canadian financials also have about 35% to drop to round trip their irrational QE3 launch. And that too may be but a mid-way point in capitulation this cycle.

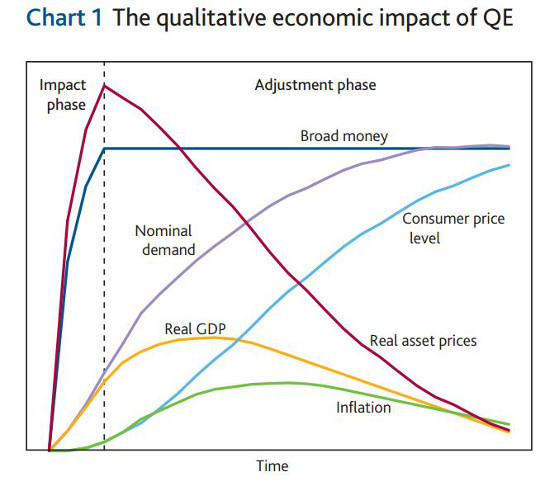

As permabulls aggressively buy dips with the lowest cash levels in history (see here), practical people should keep in mind no free credit lasts forever, and central bankers have always expected a relapse for asset prices after the initial ‘impact phase’ of Quantitative Easing had passed. This graphic from the Bank of England offers a reminder.