Michael Lewis has said he believes that Barrack Obama did not push to break up the big investment banks when he had the opportunity as he came to power amid the great financial crisis, because Obama just didn’t understand that the change was foundational to rebuilding the global economy. In my opinion this has been the greatest error of Obama’s tenure. They had a rare opportunity to do something really transformational–and they didn’t take it. Instead they endorsed the status quo and left the banking criminals to double down. The world is now facing a next, larger wave of financial crisis. Only this time, ‘rescue’ options have already been exhausted.

As political campaigns progress in 2015/16, it is important that voters demand candidates take a public position on this issue now. We can’t afford more fumbles, it is critical that the next public representatives understand what must be done. Better Markets is helping to provide the context needed to educate the public in this area. See The American People need to know where candidates stand on Glass-Steagall:

For more than 60 years, the Glass-Steagall Act kept those activities separate and, during that time, the U.S. had the highest rate of economic growth in its history while the financial system avoided catastrophic crashes. But this law was effectively repealed with the passage of the Gramm-Leach-Bliley Act in 1999, which was part of a larger successful push by Wall Street and its bipartisan allies to dismantle many of the safeguards put in place to protect the American people after the Great Depression in the 1930s.

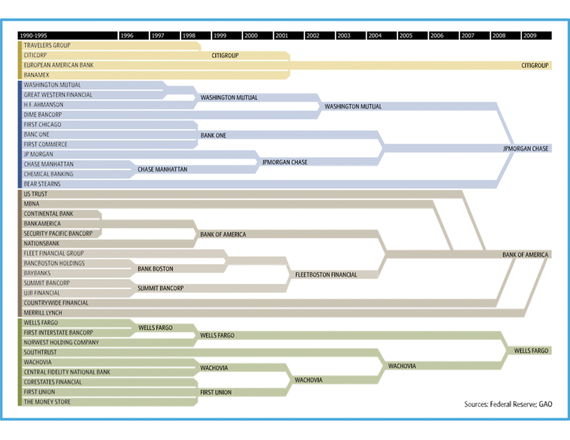

Once Glass-Steagall was repealed, large financial institutions were able to acquire other financial institutions and combine lower-risk traditional banking and higher-risk Wall Street trading and securities activities. These mergers are what threatened taxpayers and risked massive bailouts because, if the uninsured investment banking activities of a megabank got into trouble and threatened to take down the FDIC-insured part of the bank, then the government would inevitably have to save both parts to save the insured part.

Repealing Glass-Steagall unleashed an acquisition spree that made the biggest banks much bigger, more complex, more interconnected and much greater risks to the country…just the top 6 banks grew their assets from about 20% of GDP in 1997 to more than 60% of GDP by 2008.

This chart shows all of the many firms that have been consolidated to become 4 of today’s largest bank offenders. Click on the image for larger view.