The number of companies with the worst credit ratings and most negative outlooks jumped to 195 in December. Thirty-four of them were in the oil and gas sector, but 33 were financial companies, underlining the close nexus between energy and other sectors. See: Debt distress at highest level since recession.

The bond markets are starting to factor in the dangerous combination of rising interest rates as well as profit weakness in several sectors. The U.S. distress ratio – a measure of the amount of risk the market has priced into bonds – hit 20.1% in November, which is the highest level since hitting 23.5% in September 2009, says S&P. That’s an onerous indicator since September 2009 takes investors back to the last recession.

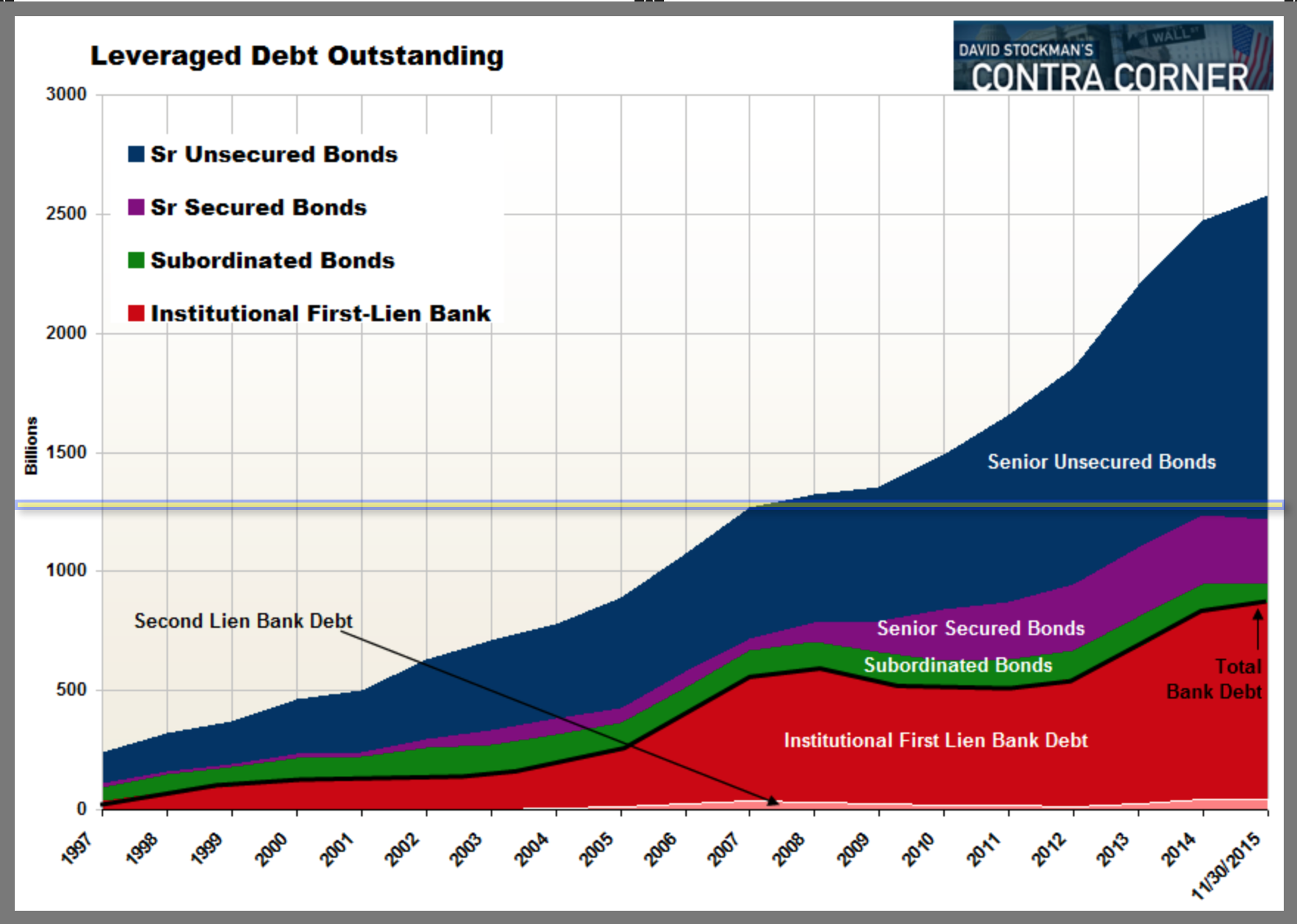

There is very good reason for distress in the corporate sector, debt levels have positively exploded over the past 7 years as companies have borrowed to jimmy rig earnings growth via buybacks, mergers and acquisitions. Think this trend is sustainable?

Despite the buybacks, net income has been weakening for over a year and it’s not just energy. Third quarter 2015 reported earnings for the last 12 months, came in at $90.66/share down 15% from the $106 reported in Q3 2014. This puts S&P 500 earnings back at the same level reported in Q2 2013, when the S&P was 1600–some 22% below current levels. See: Safe on the sidelines

Despite the buybacks, net income has been weakening for over a year and it’s not just energy. Third quarter 2015 reported earnings for the last 12 months, came in at $90.66/share down 15% from the $106 reported in Q3 2014. This puts S&P 500 earnings back at the same level reported in Q2 2013, when the S&P was 1600–some 22% below current levels. See: Safe on the sidelines

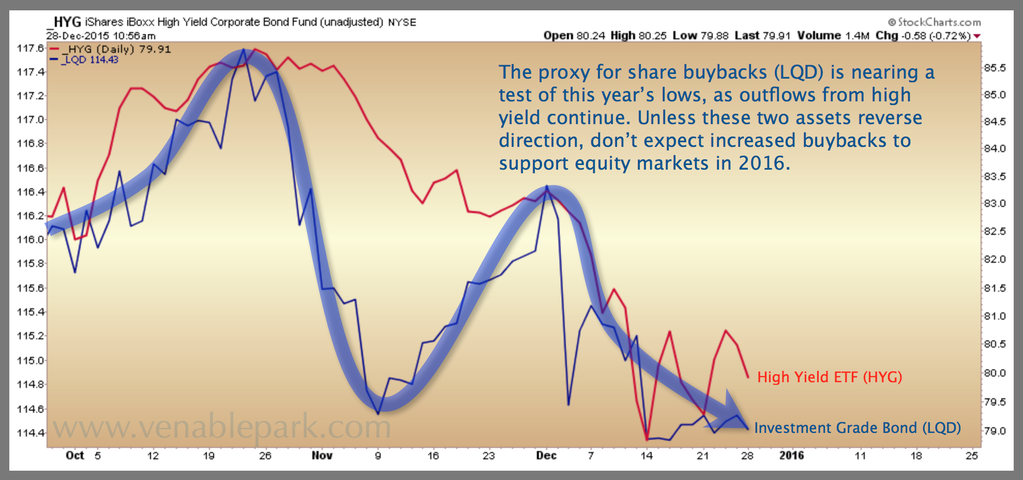

The trouble with hopes that continued buy backs will reverse negative earnings trends in 2016 is that the source of record buybacks the past 3 years–cheap corporate debt–has ended. Corporate bonds have plunged and yields have soared across the spectrum. CCC credits that were borrowing at 8% in 2014 are now having to pay 18%. The math of leverage has officially turned brutal.

And its not just junk credits that are blowing out. As shown below, flows are moving out of investment grade corporates (LQD in blue) too.