The consensus that was supremely confident and risk-oblivious when valuations were outrageous, is starting to become concerned and gradually terrified as prices re-couple down to economic reality. This is the usual emotional swing that transpires each market cycle but particularly where record levels of debt and leverage were used, as was this time. This clip reflects the sense of horror spreading through the oil sector and its related financiers. Panic in the host’s voice is getting palpable.

Macro Risk Advisors Chief Energy Strategist Chris Kettenmann explains why oil will head to $20. Here is a direct video link.

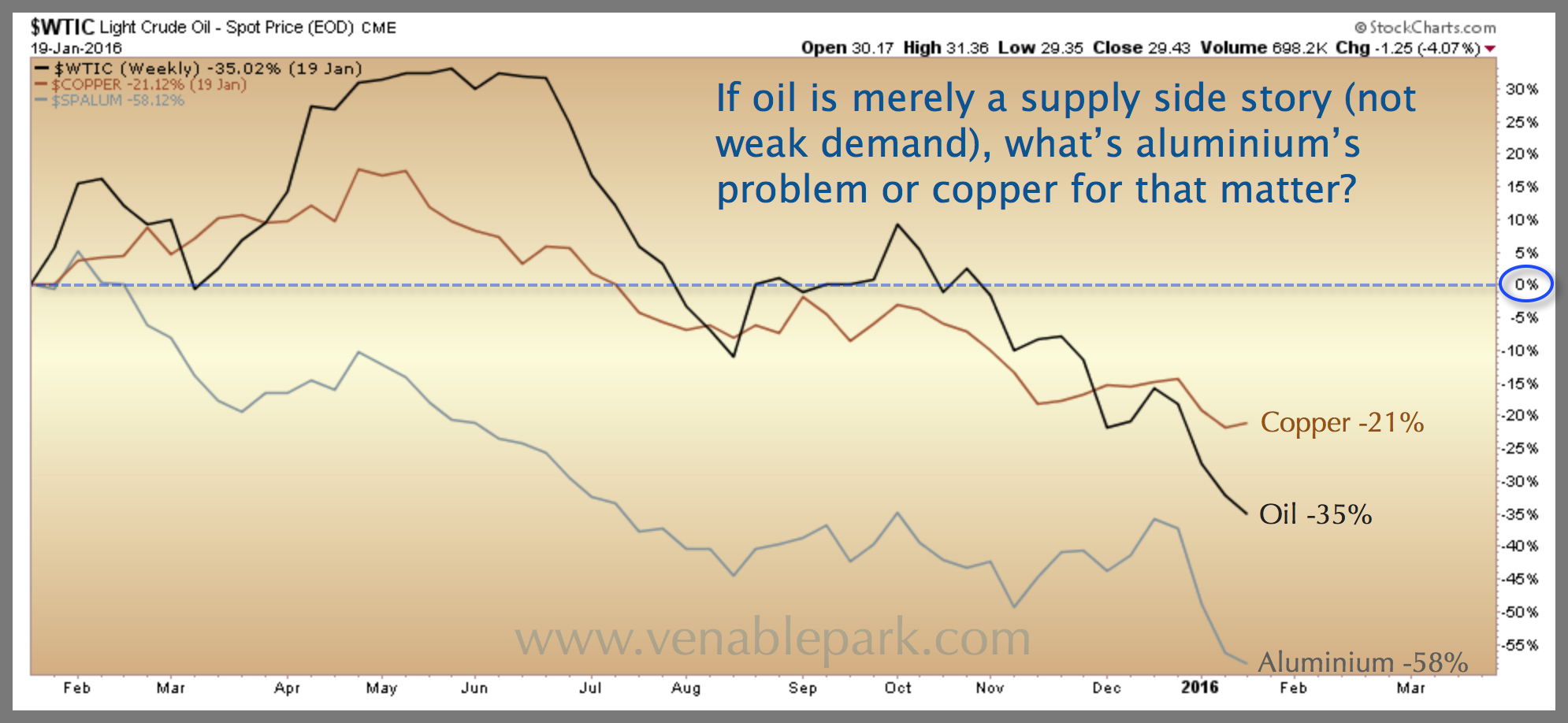

But here’s a broader question: while the masses are now focused on when the oil glut will clear, few are even mentioning the plunge in other key economic indicators. If the oil story is all about its supply-specific imbalances, what’s going on with Doctors copper and aluminum then? They seem to be confirming a broad demand downturn.