A tear-down house on our street (one hour north of Toronto) was listed for 850K yesterday. We shall see what happens; but since people can still buy up to 1m with a minuscule 5 to 7.5% down and the rest in a loan backed by we, the taxpayers, crazy prices are now epidemic and spilling from downtown areas far into the suburbs. The math and financial sense it, of course, are loonie tunes. See: Ugly math in Canada’s over-valued property market.

But with most of the ‘experts’ in the sector making up front commissions and fees on appraising, originating mortgages and moving properties, and politicians placating industry lobbyists and voters who want to get on the property ladder at all costs, there are few people with any interest in seeing the risks in all this.

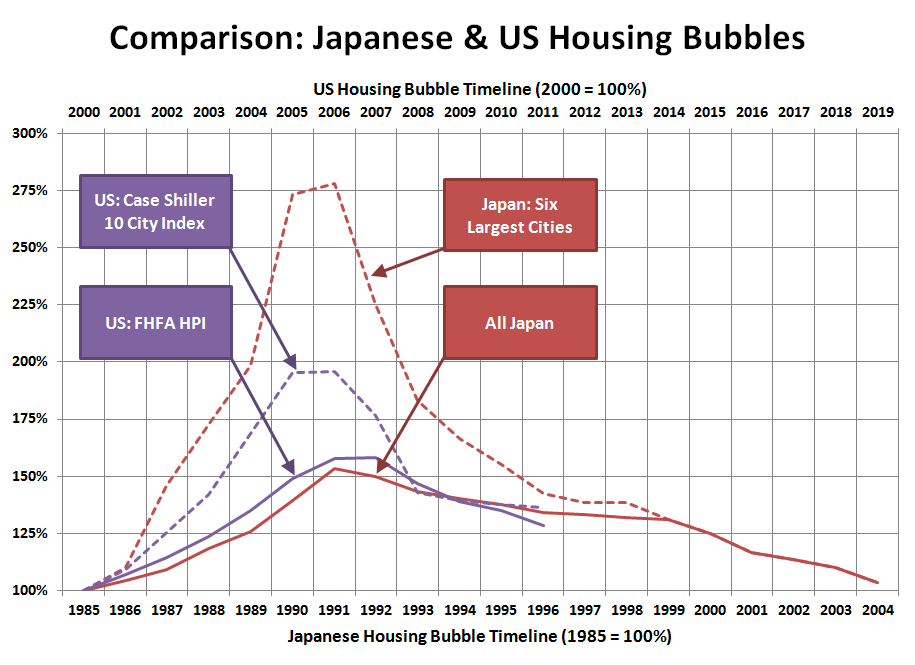

Many naively believe/argue that home buyers can ‘afford’ these prices or that Asian cash buyers are an endless stream. The same foolish thinking was dominant in the late 80’s as Japanese buyers moved capital into North American real estate and out of their own bubbling markets at home. This chart shows what happened to realty prices in both the US and Japan over the full cycle. If Canadian realty was included, it would show similar movements both in the 1985 to 1995 period, and also in the price boom between 2005 to date.

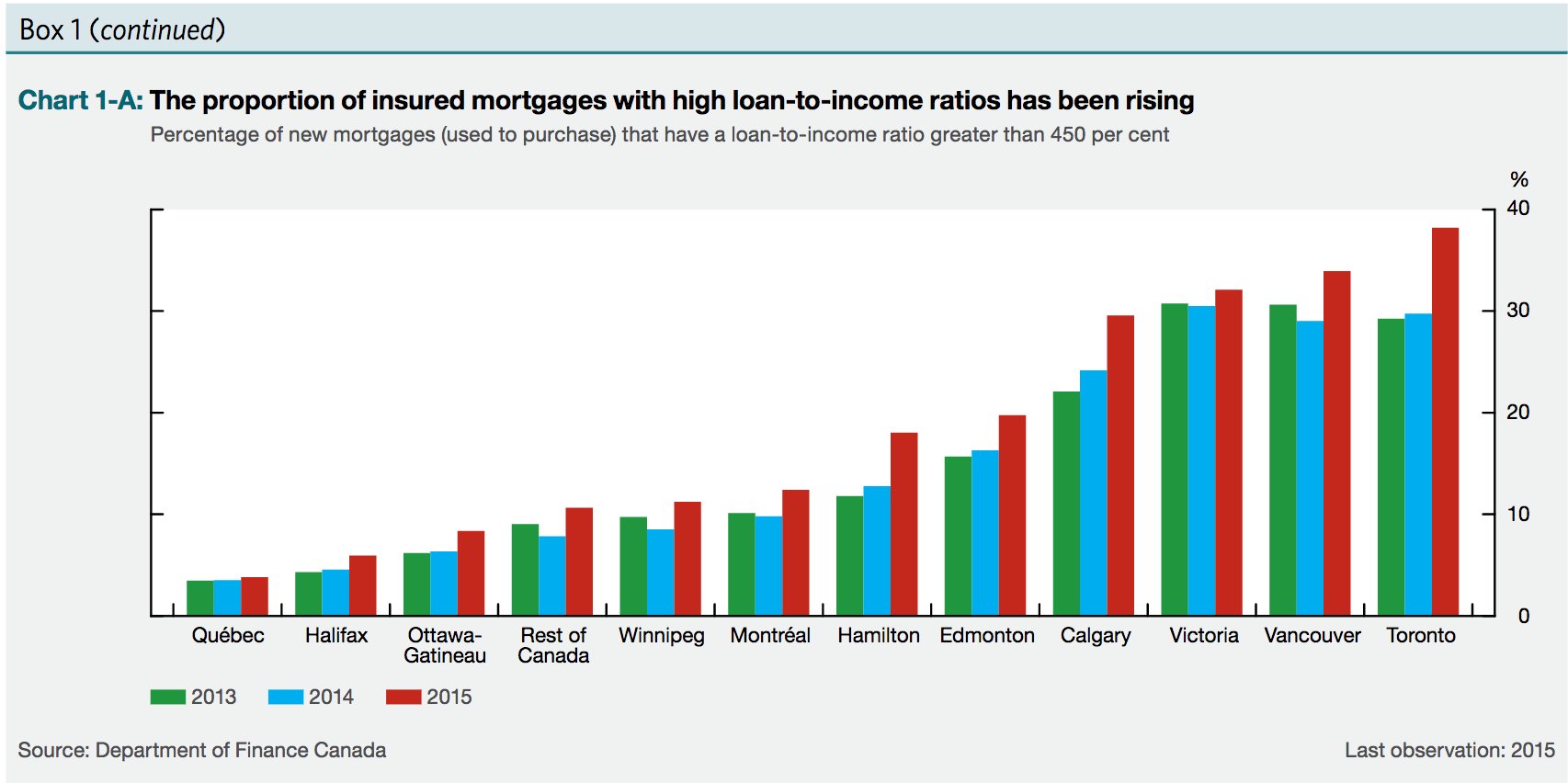

This chart courtesy of the Bank of Canada shows the alarming truth about the trend in government (taxpayer) insured high-loan-to income ratios over the past 3 years in Canada’s hottest markets. New loans that are greater than 450% of household income are now more than 30% in Calgary, Victoria, Vancouver and Toronto.

This chart courtesy of the Bank of Canada shows the alarming truth about the trend in government (taxpayer) insured high-loan-to income ratios over the past 3 years in Canada’s hottest markets. New loans that are greater than 450% of household income are now more than 30% in Calgary, Victoria, Vancouver and Toronto.

History assures us bubbles are amazing on the way up and financially devastating on the way down. As Bank of Canada head, Stephen Poloz admitted on a panel May 3, 2016: “There’s a crater under every bubble. Every one.”

History assures us bubbles are amazing on the way up and financially devastating on the way down. As Bank of Canada head, Stephen Poloz admitted on a panel May 3, 2016: “There’s a crater under every bubble. Every one.”

But even though the head knows this, the heart and will to do wiser things are painfully weak. And so it goes: an ominous credit fueled crater is deepening beneath the Canadian economy with each passing week.