Lance Roberts has written a rare and useful response to the usual buy and hold, long-always marketing propaganda recently reiterated encore on Forbes.com in Why you shouldn’t worry about market corrections. No surprise in this message of course: Forbes is after all, sponsored by the sell-side, Fortune 500 companies and long-always asset allocation firms who earn fees by getting others to part with their cash and buy the products and securities they are selling. We have all read many articles and books espousing the mainstream thesis that we should always buy and never sell risky assets.

As a antidote, Lance patiently takes us through each part of the Forbes article and carefully explains, with some excellent charts, why long-always assertions are harmful to real life people with finite savings and life spans. The article revisits and echoes all of the points which I lay out in Juggling Dynamite (2007), and Lance’s updated charts are valuable. Read: Yes! We should worry about market corrections. Can we stop the nonsense? Please

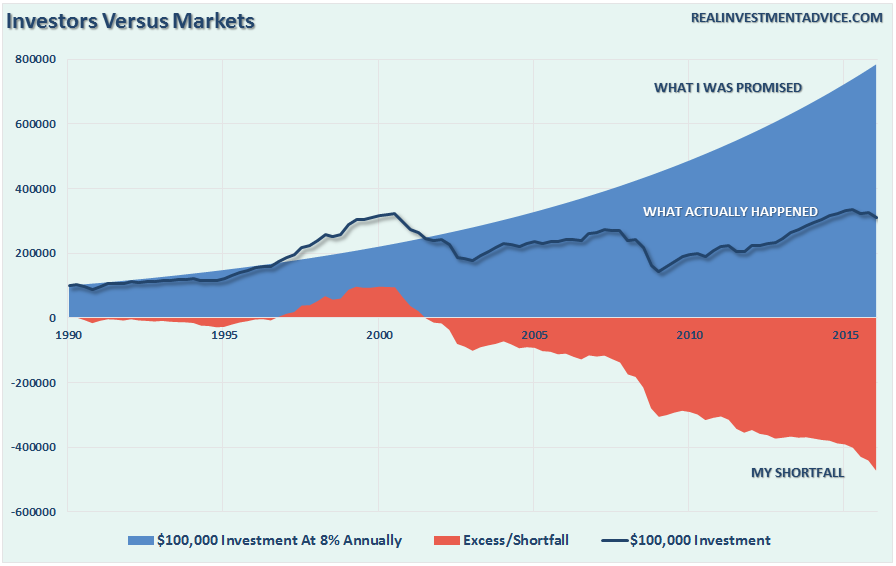

This chart effectively shows the compounding harm in buying the sales puff of the investment ‘business’. People are not earning the returns they planned on or were ‘promised’ and in the process they have been spending too much and saving too little, all of which magnifies the negative effects of bad advice over time. It is precisely this toxic thinking that has been hollowing pensions and retirement plans from the inside out over the past 20 years. Every year we are getting older with less time to make up capital shortfalls. We must stop taking our financial advice from the product sales crowd!!

So many hard working people thought they were well set up for a comfortable retirement in 2000 and 2007, only to be set back more than a decade by intervening bear markets that followed. Today many are starting to retire or are once more hoping to do so within the not too distant future. The trouble is that assets held in portfolios are back at nosebleed valuations for the third time since 2000.

So many hard working people thought they were well set up for a comfortable retirement in 2000 and 2007, only to be set back more than a decade by intervening bear markets that followed. Today many are starting to retire or are once more hoping to do so within the not too distant future. The trouble is that assets held in portfolios are back at nosebleed valuations for the third time since 2000.

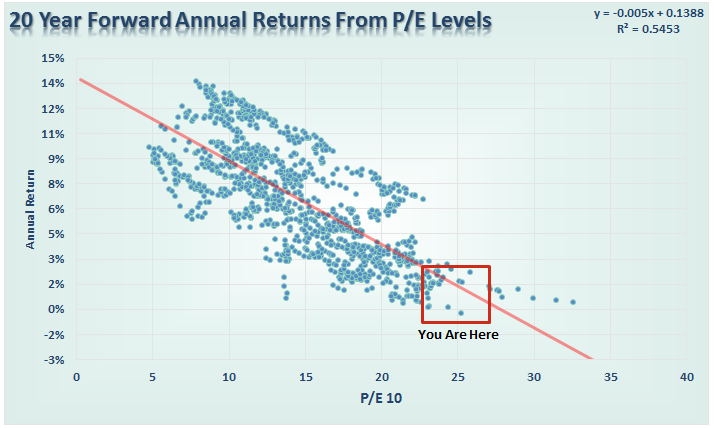

As shown in the red box below, at currently extreme valuation levels, equities are priced to deliver returns of about zero with heart stopping volatility over the next 20 years. Who has enough time to wait that out? Ask yourself, what’s in it for you? And a warning to those who are today holding mutual funds and ETFs with innocuous sounding names like “Income”, “Dividend”, “Conservative”, “Balanced” funds, you are holding these same dangerously over-valued risk assets inside the marketing wrapper. Don’t kid yourself!

The trouble is that most people spend their 20-50’s paying off their student loans, mortgage, raising their kids. They don’t amass the bulk of their life savings until they get into their 50’s and 60’s. At that point large market drops are particularly stressful to endure, especially since from secular highs, it can take decades to recover capital losses.

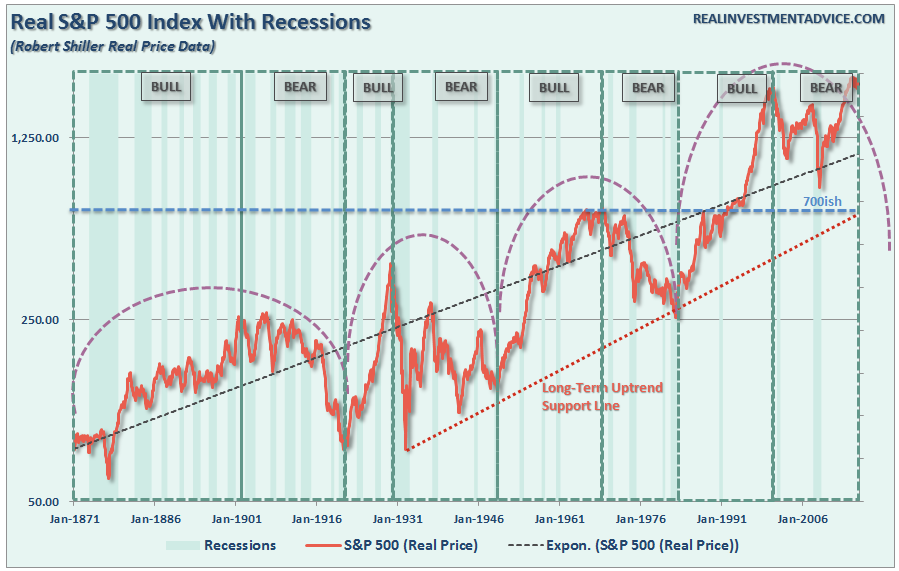

As shown in this long term chart of the S&P since 1871, there have been 4 secular bull and 4 secular bear cycles in the past 145 years. Lasting returns were only made for buy and hold investors that happened to have their savings in equities during the 4 secular bull periods. During the secular bear periods, holders actually experienced negative real returns. Today we are once more at a cyclical high within the secular bear that began in 2000. Ignoring this reality is a very bad financial plan. There is a better way! We have been managing to grow and not harm capital throughout this period. The reward is getting through the fourth secular bear since 1871 in tact, with our savings preserved and liquid, able to take advantage of the next secular bull period which is coming. Valuable opportunity will be born out of the crushed valuations of the next mean reversion period. It’s not if, it’s only a matter of having the discipline to prepare for the ‘when’. The great news, is that we must be getting very close.

As Lance reminds us:

This time is “not different.” The only difference will be what triggers the next valuation reversion when it occurs. If the last two bear markets haven’t taught you this by now, I am not sure what will. Maybe the third time will be the “charm.”