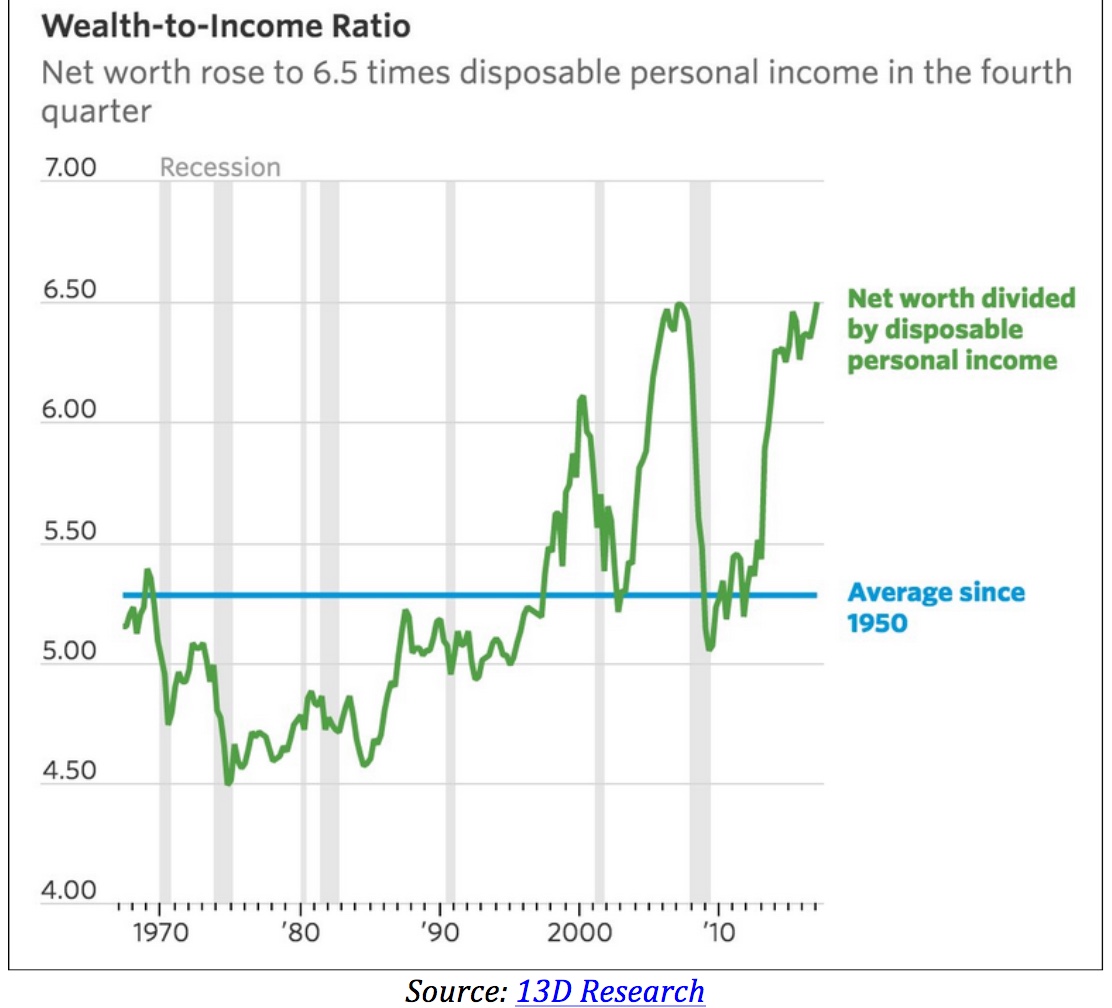

Good perspective on the impact of bubblenomics and asset price gains, relative to income, courtesy of Patrick Watson today in Charts that Matter:

“More net worth is always good, right? Not necessarily. This chart from 13D Research shows US household net worth divided by average disposable personal income over the last 50 years.

If you do everything right and are lucky, your net worth should be greater than your income. But if it is too high relative to your income, it may be unsustainable. Peaks tend to coincide with recessions and bear markets. Today, the ratio is near an all-time high and very close to the last peak just ahead of the 2007–09 recession. That vicious bear market knocked the ratio back down to its long-term average. It has since crept higher again. In fact, much of the net worth was illusory in the first place. Housing accounts for a big part of it, with both banks and homeowners marking property values well above realistic selling prices. It may be happening again.”

It reminded me of this chart of the incredible leap in Canadian and Australian household wealth relative to other countries in 2016, courtesy of bubbling realty prices. Since few cash out when asset prices are unreasonably high, most will keep holding as their net worth retreats through the mean reversion cycle once more.