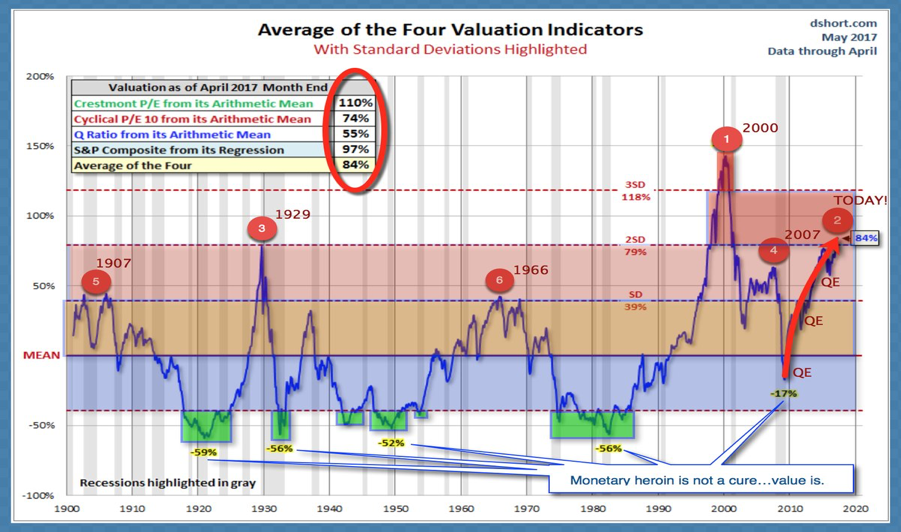

This morning as the financial sales force dominates the airwaves with all the usual assurances that there are no reasons to be defensive of our savings and no signs of a bear market or recession coming [ever again], some factual antidotes are always valuable.

First we have this updated chart showing today’s levels on four of the most historically reliable stock market valuation readings, compared with all the other cycle tops and bottoms since 1900.

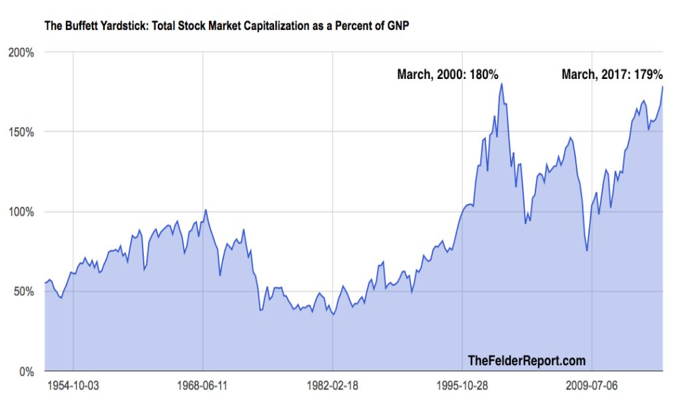

Next we have this chart showing the total US stock market capitalization (total price) as a percentage of gross national product (Buffett’s so-called favorite measure) since 1954. Present levels have now reclaimed the all time secular peak of March 2000.

All that’s needed now is a sudden turn in participant sentiment, from irrational-exuberance to panic. At present levels of extreme debt and leverage, sentiment can turn on a dime.

Unfortunately, the masses never realize they are in a burning building until the ceiling starts falling on top of their heads. Then they all try to exit at once.