My article here yesterday on the Bank of Canada being the least capitalized bank in the Western world, spurred another round of reader emails about risks in the banking system and particularly to bank depositors.

This is a very troubling issue for all of us. It is one thing to chose to put your capital into the risk of publicly traded securities. It is another entirely where one intentionally chooses to forgo the potential for higher gains in order to avoid the accompanying potential for losses and so opts for ‘low risk’ cash deposits.

The Cyrpus bank insolvencies in 2013 rightly brought international attention to these issues as depositors in that case lost large portions of their capital. Shortly thereafter many countries including Canada tendered proposals “to implement a ‘bail-in’ regime for systemically important banks”. In fact however, bail ins on bank restructuring have historically been the norm not the exception. The renewed interest in this concept was born not out of the events in Cyprus, but rather out of the outrageous bank bail outs by taxpayers that took place in the US, UK and some parts of Europe during the financial crisis of 2008.

The distinction between a bail out and a bail in in this context is important to understand. Bail outs, where governments step in with taxpayer funds to provide capital shortfalls needed when a bank becomes insolvent, are highly unusual. The normal capitalistic model is for bail ins where the bank stakeholders are on their own in resolving the bank and investors, lenders and depositors form a hierarchy left to divvy up assets and absorb any losses where remaining capital falls short. This system worked well for many decades in keeping everyone from bank management to investors, depositors and regulators highly focused on managing capital risk, since a failure was appropriately their own to absorb.

What was so shocking in the financial crisis of 2008, was that governments did not just pledge taxpayers to bail out depositors in mismanaged banks, but they also made whole a select group of some of the investors–the senior bondholders–many of whom where other banks, governments, pensions and elite investors. The argument was that banks had gotten so large, interconnected and leveraged, that if their bondholders were to take losses then the damage would be circular and the entire economy would collapse. If this were true, then this is one of the most obvious arguments for why banks are too big to appropriately risk-manage today and why Glass Steagall-like break ups are the only reasonable path ahead.

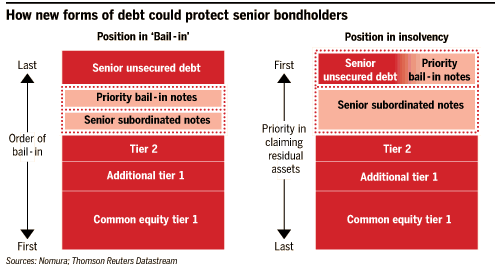

But back to risk to depositors. In some European countries, senior bondholders and depositors are afforded the same priority of security. In other words, they lose last if necessary, but only after all other investors and lenders have sacrificed their invested capital. In North America however, there has been a long legal precedent of “depositor preference” over senior bondholders, meaning that all investors in the capital structure lose their money before depositor capital is at risk. The following chart offers a helpful overview of the existing capital hierarchy (in red) and the additional buffer levels that have been proposed (in pink).

*preferred shares typically fall higher than common equity but below bond holders in the capital security hierarchy above. Depositor capital would only come into harm’s way after all of these other levels of capital have been fully exhausted.

Right now in North America all of the levels of investor capital outlined above are at risk of loss before any harm falls on the depositors. When banks are appropriately funded in their capital structure, and they get into financial trouble, they should still have sufficient investor capital on hand to pay back uninsured customer deposits.

The trouble is that over the past 15 years we have allowed banks to hold less and less capital reserves and take on more and more leverage and become recklessly concentrated to the point that security for all stakeholders has been diminished. This point was made clear to all parties in the crisis of 2008 and ended up extorting trillions of taxpayer dollars all around the world to “bail out” investors. Unfortunately following the initial terror and government rescues, no meaningful reforms were demanded, and banks went right back to their financially suicidal habits leaving the next crisis looming and “we” the depositors and taxpayers still facing unnecessary risks.

The recent bail-in proposals by governments are not about putting depositors at greater risk but the opposite: the proposals are for a wise beefing up of the capital structure to add more lines of defense in advance of senior bondholders and ultimately depositors.

Some readers have asked if Credit Unions offer safer deposit structures for their customers. Unlike banks, which raise capital by issuing bonds or selling shares, a credit union can only make loans out of its retained earnings, so this is generally a built in limit on their leverage risk. Credit unions theoretically only answer to their depositors, who want better service and lower rates. Banks on the other hand, are driven most by shareholders and management who are focused on incessant growth in the common equity market cap. That said, Credit Unions have also been consolidating into fewer and more concentrated institutions the past 15 years and so a review of each particular institution is a necessary step.

All of this said, money under the bed is at risk of permanent loss from things like fire and theft. We need the utility of banks in a modern economy. The answer is not to avoid them, but to be cognizant of risk and manage our exposure like adults. At the same time we must relentlessly demand a restructuring of ‘Too-big-to-bail’ banks back to smaller institutions with clear guidelines and risk-controls, higher capital ratios and a clear operational division between traditional deposit-taking and the speculative pursuits of actors who must be forced to live and die on their own dime.

We can and we must. The other way lies madness.

“If we want to have a healthy, sound financial sector, the only way is to say: ‘Look, where you take the risks, you must deal with them, and if you can’t deal with them you shouldn’t have taken them on and the consequence might be that it is end of story’. That’s an approach that I think we, now that we are out of the heat of the crisis, should consequently take.” –Jeroen Dijsselbloem, President of the Eurogroup, March 2013