The investment sales world loves to talk about the defensive benefit of holding different equity sectors and global markets.

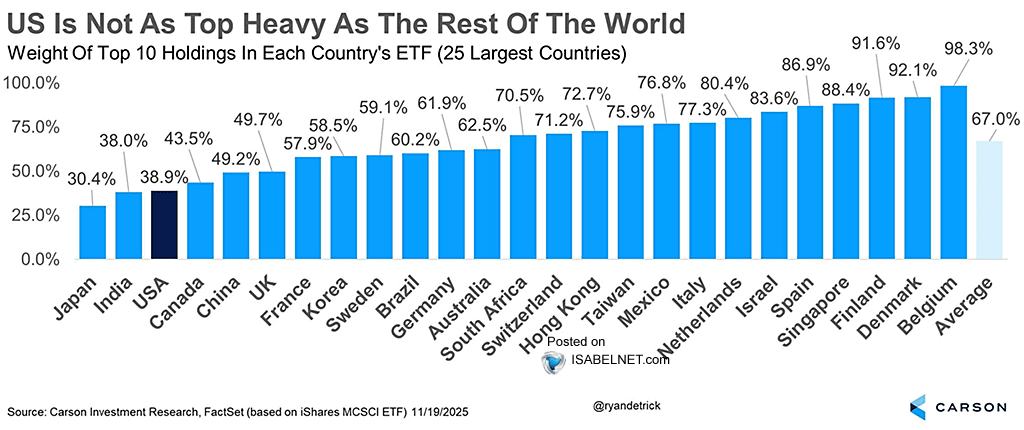

The pitch is that there’s always a bull market somewhere, so we can always-be-buying risk-on products. The US stock market is heavily concentrated (39%) in the top 10 most expensive companies today (dark blue bar below). No problem, we are urged to ‘diversify’ abroad. The trouble is that other global equity markets are nearly all more concentrated than the US (shown below, courtesy of ISABELNET.com).

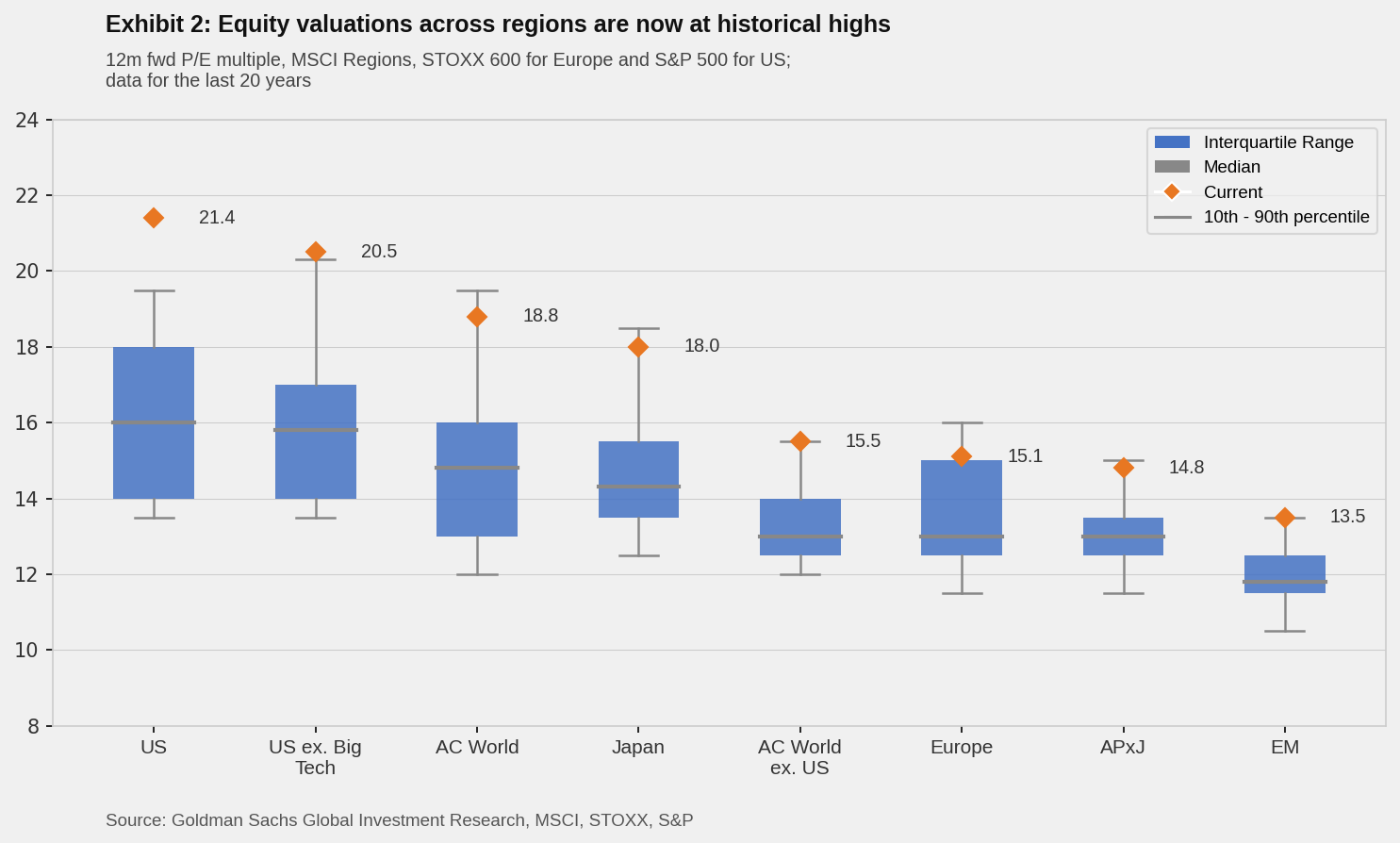

Moreover, today, inflated prices are global, with equity valuations at historic highs across all major markets (the 12-month forward price-to-equity multiple, shown below in orange, versus the median for each region over the past 20 years).

Moreover, today, inflated prices are global, with equity valuations at historic highs across all major markets (the 12-month forward price-to-equity multiple, shown below in orange, versus the median for each region over the past 20 years).

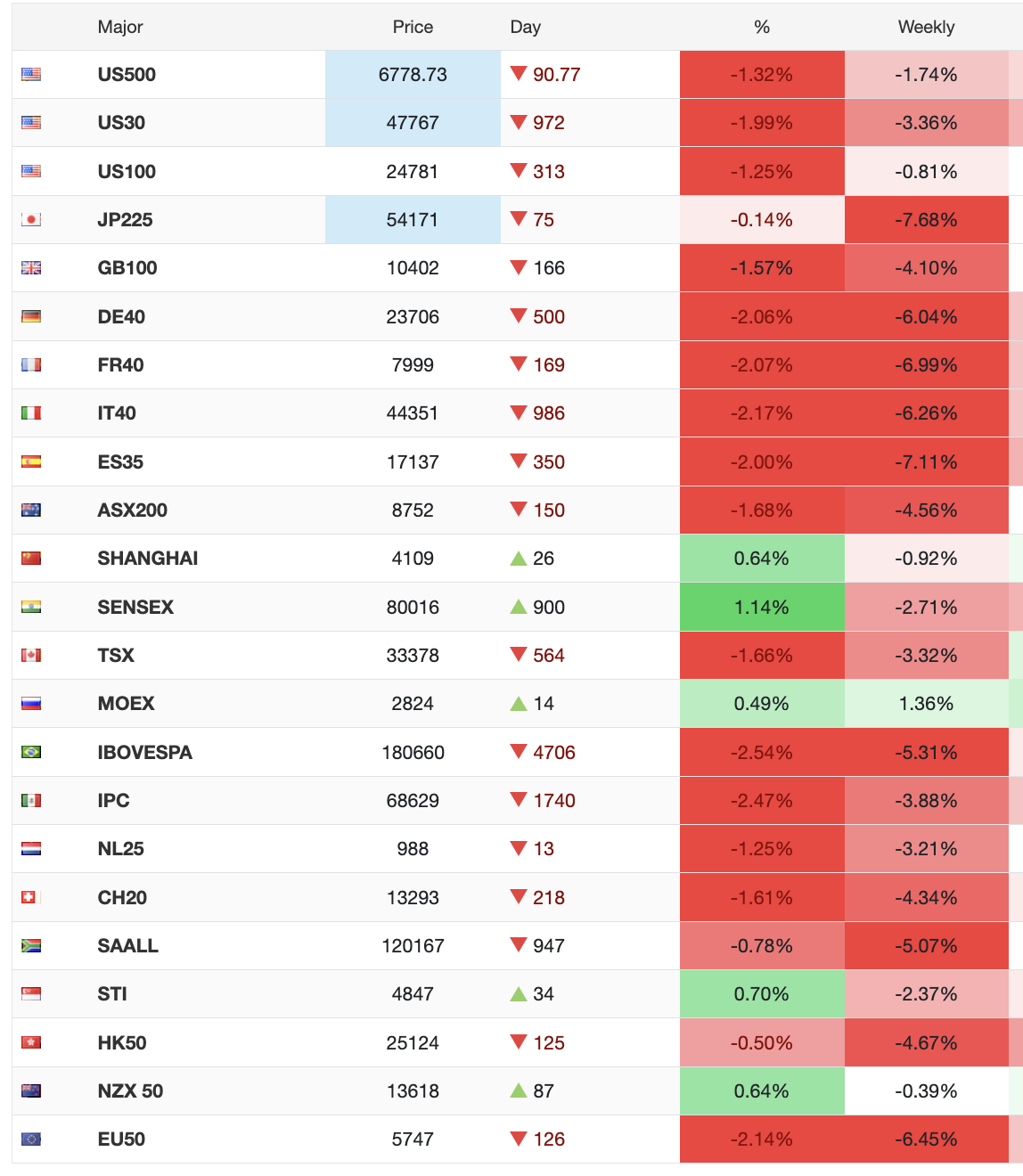

In real life, correlations are strongly positive across global markets, particularly in sell-offs. Case in point, all major stock markets except Russia’s (MOEX) have been negative over the past week (in red below). Diversify this.

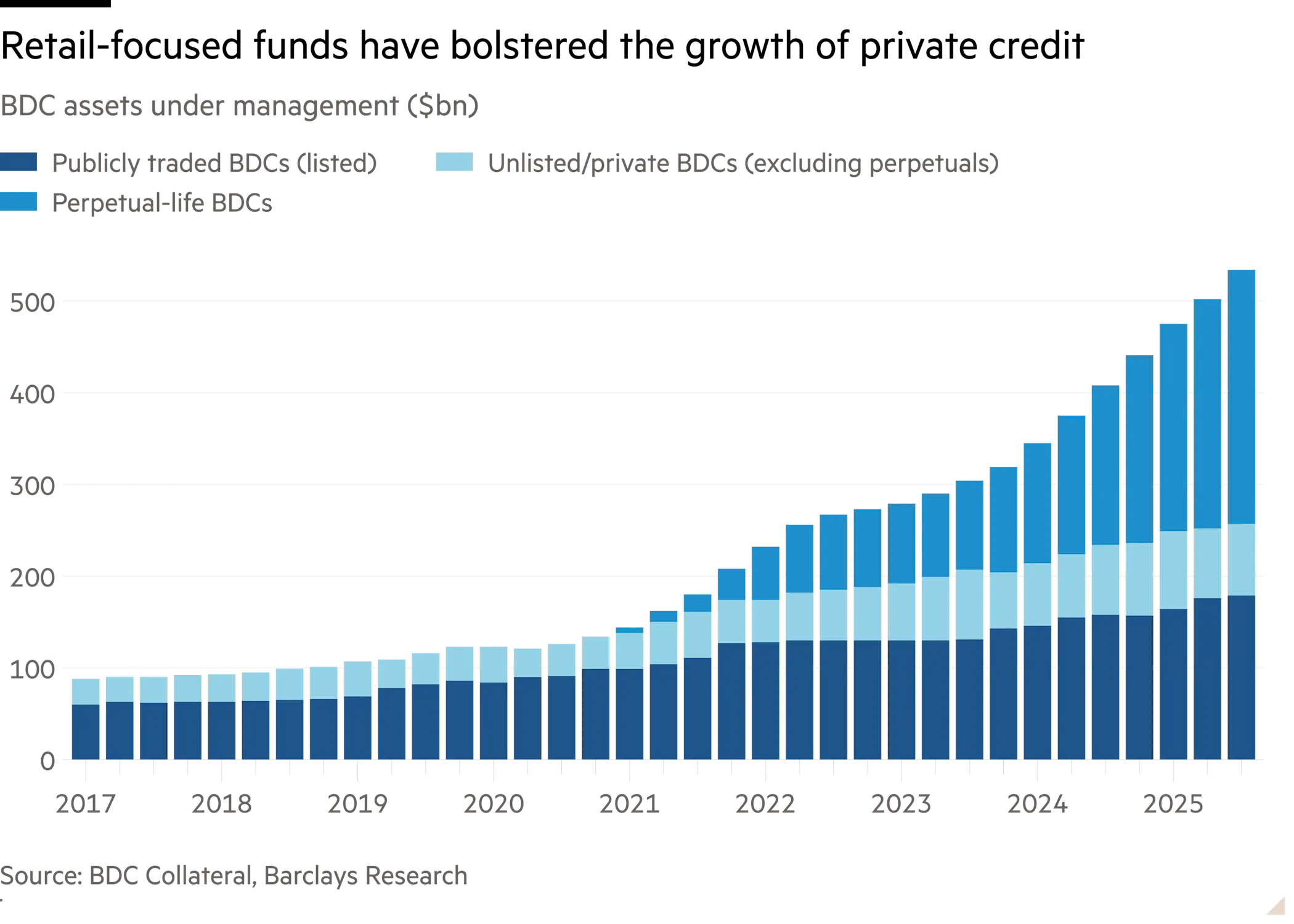

Protecting capital from the downside of asset bubbles requires more than just different equity marketing wrappers. Crypto isn’t holding up, precious metals and credit are slipping, too. Cash-like equivalents and short- to medium-term individual Treasuries with fixed maturity dates are the most stable allocations — unfortunately, few people hold them in any meaningful weight.

Protecting capital from the downside of asset bubbles requires more than just different equity marketing wrappers. Crypto isn’t holding up, precious metals and credit are slipping, too. Cash-like equivalents and short- to medium-term individual Treasuries with fixed maturity dates are the most stable allocations — unfortunately, few people hold them in any meaningful weight.

It’s tough to buy low when the masses are maxed out at all-time cycle highs, with little to no cash on hand for buying opportunities that come in bear markets. Poor risk management means the masses often bear capital risk without capturing the promised rewards. In the end, the house gets richer, and individuals end up losing over full market cycles. Rinse and repeat.