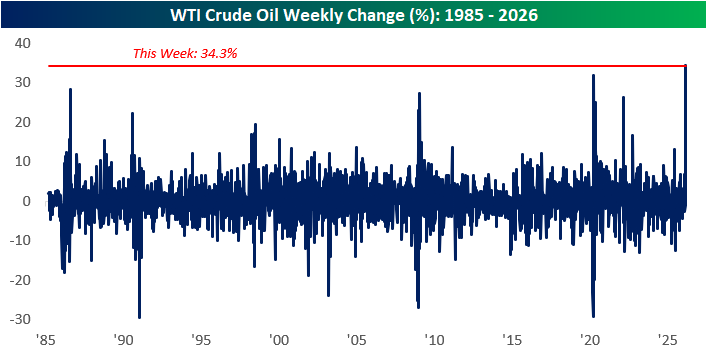

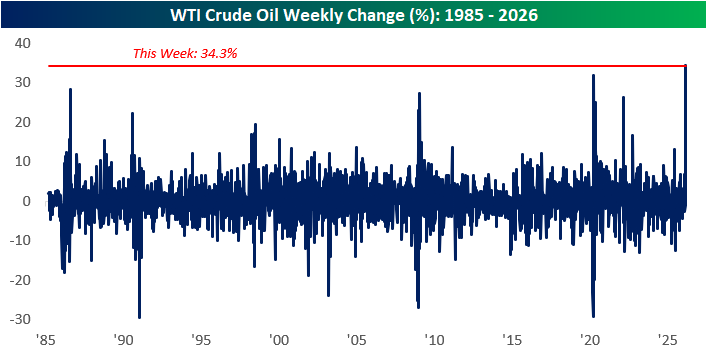

Last week’s near 35% spike in the price of oil (WTIC) was the biggest gain in futures trading history, dating back to 1983 (shown below, courtesy of Bespoke Investment Group).

After closing at $90.90 a barrel on Friday, the price rose to $119.48 intraday yesterday, then slumped 15% to $80 this afternoon. That’s still up 47% year to date and +32% in the past month.

After closing at $90.90 a barrel on Friday, the price rose to $119.48 intraday yesterday, then slumped 15% to $80 this afternoon. That’s still up 47% year to date and +32% in the past month.

How long oil prices will remain elevated is impossible to predict. But initial price spikes are typcially short-lived because a higher price dents demand.

When Russia invaded Ukraine on February 24, 2022, crude peaked at an intraday price of around $125 (WTI) and $128 (Brent) on March 8, 2022, just days after the invasion began and then pulled back relatively quickly, returning to $66 a barrel (WTI) by March 2023.

That said, the Iran war impacts more oil flow than Russia’s assault on Ukraine. About one-third of global oil production comes from the Middle East, and much depends on how long the Strait of Hormuz remains disrupted.

As for potential upside for Canada in this, RBC economists note that price volatility driven by geopolitical events is unlikely to be viewed as structural enough to reverse the decade-long decline in Canadian oil and gas investment. And, without an investment response, the near-term impact on gross domestic product will likely be neutral.

Energy producer profits and government natural resource royalties rise alongside oil prices, and this is true for Canada and the U.S. as oil exporters. In Canada, the sector is smaller than a decade ago, but still accounts for 6.6% of GDP and 15% of total goods exports in 2025.

In the U.S., vulnerability to oil price shocks has diminished dramatically in recent decades, with production ramping up following the shale revolution—from 5.4 million barrels a day in 2004 to 13.5 million barrels a day in 2025 (EIA estimates). The U.S. has swung from being a net importer of energy products to a net exporter over the last decade.

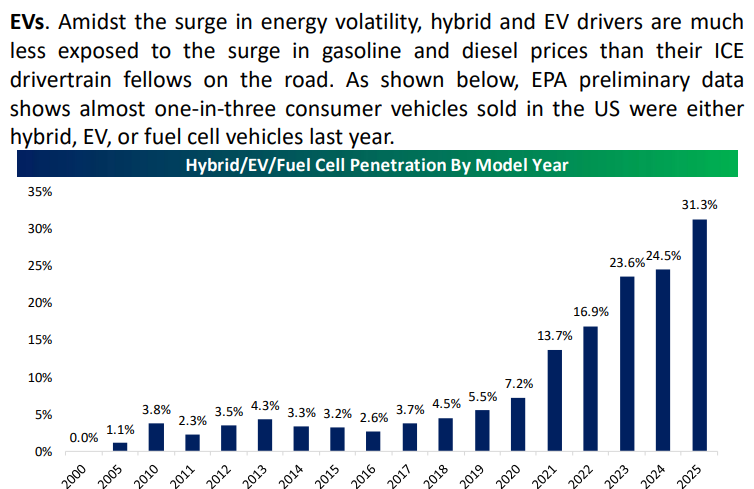

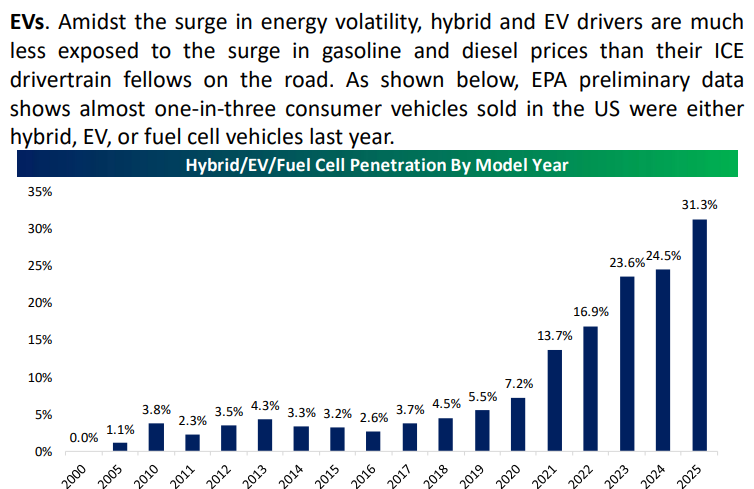

At the same time, as shown below, nearly a third of US auto sales in 2025 were hybrid, EV or fuel cell vehicles, compared with 7.2% in 2020. A sustained spike in gas prices is likely to accelerate the move away from conventional ICE vehicles.

Energy costs are a tax on everyone, and higher fuel prices mean less funding available for other spending. Here’s RBC:

Energy costs are a tax on everyone, and higher fuel prices mean less funding available for other spending. Here’s RBC:

When oil prices rise, consumers face higher prices at the pump almost instantly. As more dollars are allocated toward energy purchases, the buying power for other goods and services decline – and the longer prices remain high, the greater those challenges become. Heightened economic uncertainty may also reduce households’ willingness to spend, further dampening demand.

The economy was already weak and shedding jobs over the past year; higher fuel costs intensify financial strain.

Another broad impact is that the size and duration of the oil price surge could delay or discourage policy easing from central banks. Anticipating this, Treasury prices have fallen over the past week, driving up the yields on which interest rates are based. Rate relief remains elusive for highly indebted households, and home sales are moribund.

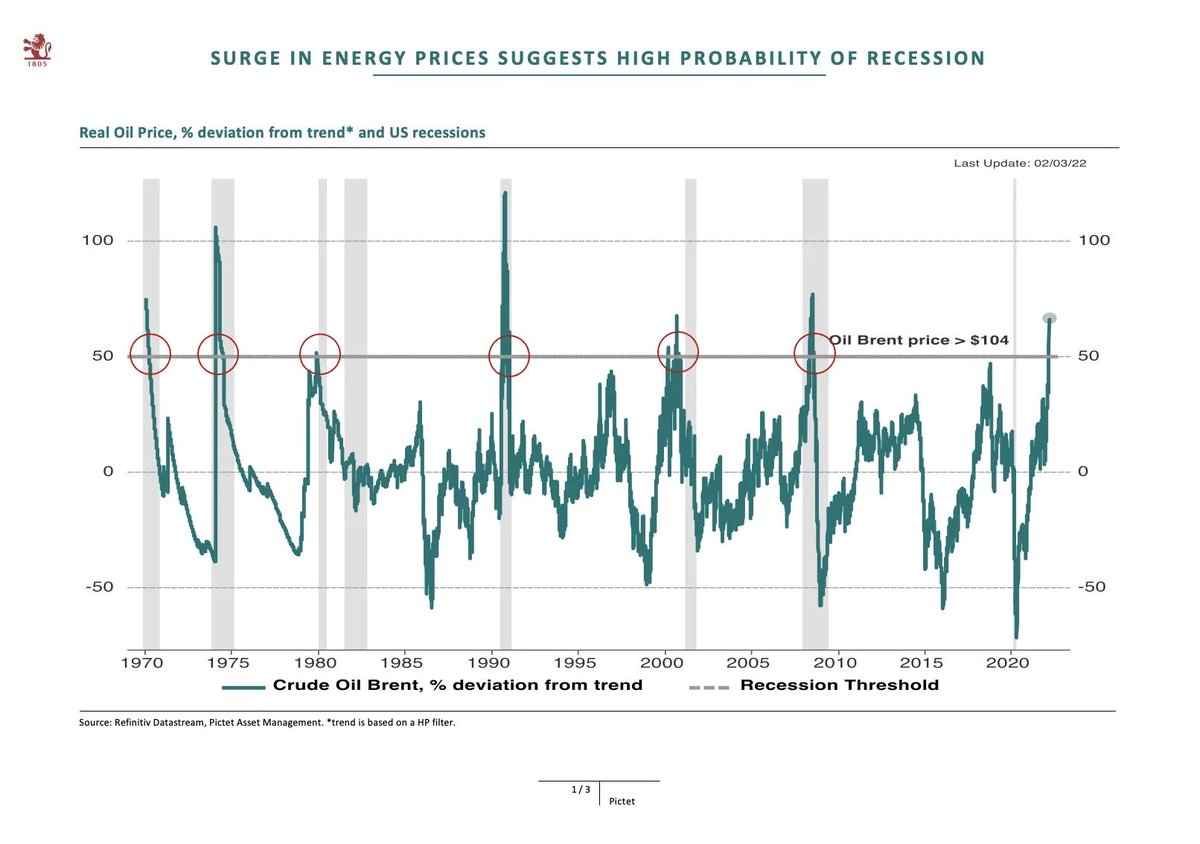

Every cycle is slightly different, but all of these are reasons that past oil spikes have typcially accelerated the onset of recessions.