Copper and C$ are continuing to fall this morning in sympathy with slowing global growth.

The bullish counter is that the ECB is now expected to add another trillion of liquidity to the already flooded European banking sector. This next round of central bank madness may manage to goose over-valued prices higher for a while longer or be the final straw to crash the already perilously strung out global financial system. We must each place our bets according with our own conscience and live with the consequences.

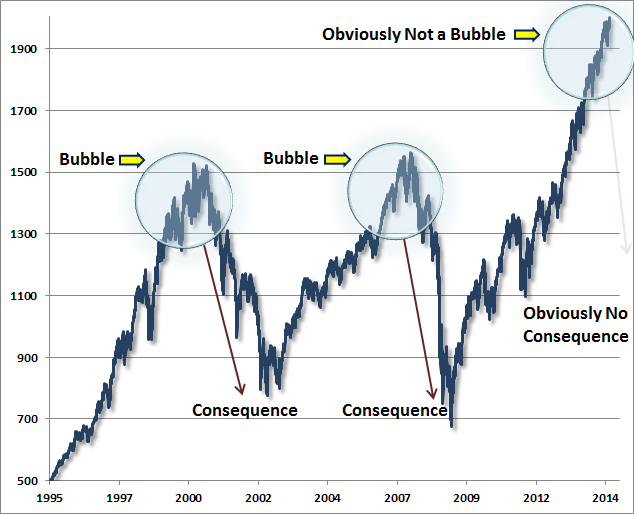

This chart courtesy of John Hussman yesterday offers a good big picture of where US equity prices and consensus thinking is today versus past cycle peaks. I can vividly recall how few commentators saw any asset bubble risks in real time in both 2000 and 2007. After prices had collapsed of course, then the consensus agreed that “obviously 2000 and 2007 were extreme valuation bubbles”. But today they see no bubble.

Today at even higher, highs, and the lowest bearish sentiment in 27 years (so an even lower number of people concerned about capital loss today than there were at the market peaks in 1987, 2000 or 2007), we few sober observers once more find ourselves in a family of heroin addicts who keep insisting that it is us worrywarts that are the problem. Fortunately after more than 20 years of experience therapy, we have come to know better!

This interview touches on some of the important macro forces that have been scaring central banks into repeated bouts of desperate measures.

CNBC’s David Faber speaks to Jeffrey Gundlach, DoubleLine Capital CEO & CIO, about his contrarian call on interest rates and the strength of the U.S. dollar. Here is a direct video link to part 1.

And here is part 2.