Some readers have expressed surprise at my endorsement of the JP Morgan plan to re-work some of their existing mortgage terms with distressed homeowners.

For the record. I am not saying anything about the government bailing out homeowners here. I am saying the parties to the contract have a reason to seek a win-win solution where possible. I am saying there was a bad contract made between many borrowers and lenders. The borrowers over-borrowed and the lenders over-lent. The banks and mortgage dealers were over-paid on the front end for business that in many cases should never have been written. Both sides were at fault. It is in the best interest of both parties to the private contract to see if they can work out a solution other than kicking the borrowers out of the home and the bank/lenders collecting empty houses they do not wish to hold and cannot sell.

John Hussman suggests the written down principle could sit as a lien on the property interest free, and the banks can re-coup the lien some day if and when the house is sold at a premium above the first mortgage. This is another way to the same end. The goal is to be creative and come up with practical solutions that are better than immediate foreclosure and lose-lose for all parties.

There will be many cases where the borrower has since lost his or her job, and so no re-work will be possible. But where you have people able and willing to salvage the contract, on necessarily revised terms, I say the parties should be encouraged to think outside the box and negotiate an agreement.

I have much more trouble with the idea that the government should bail out banks for their bad lending decisions. Banks are supposed to be experts at lending. Aren't they always telling us what experts they are! They should be expected to figure out free-market solutions to their bad business decisions.

Follow

____________________________

Cory’s Chart Corner

Load MoreHeadline chasing algos need to do deeper dives...

h/t @hussmanjp John P. Hussman, Ph.D. @hussmanjp

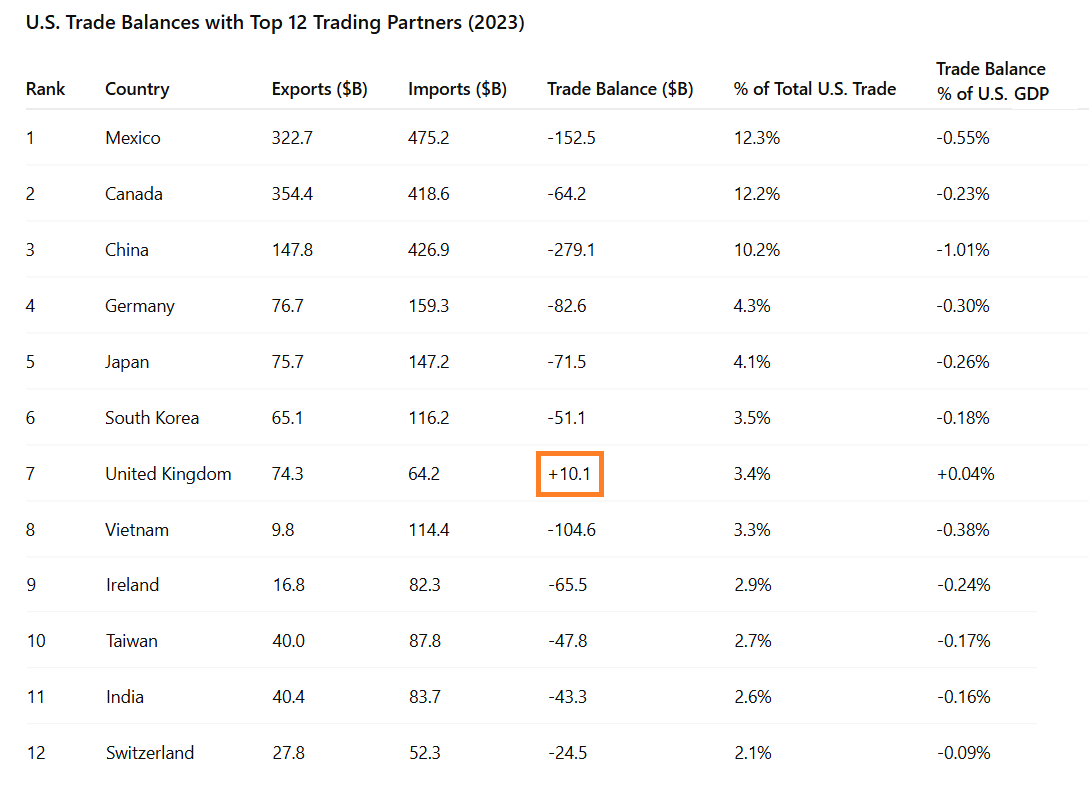

John P. Hussman, Ph.D. @hussmanjpy'all realize the UK is only about 3% of U.S. trade, the U.S. already runs a surplus there, and the 10% U.S. tariffs will stay, right?

keep in mind that studies indicate U.S. consumers shoulder the majority of tariff incidence, with minor incidence to foreign countries____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

Amen! As usual your thinking is clear and logical.

Danielle,

I respect your opinion immensely which is why I recommend your book and your blog to everyone I talk to about investments and economy, including my financial advisors. Why I am so passionately set against any easy outs for those who over invested in real estate is due to shear arrogance of many of those individuals. They got themselves in trouble through their mindless positivism, often by lying on loan applications. The banking institutions are now able, and pressured, to make deals with these delinquent home owners because of government bail outs. Without the “rescue packages” these deals would not be in the works. I do not see how these two notions can be divorced.

In the last few years we only needed to log on to any housing blog (many now defunct) to experience the superciliousness of the housing bulls. Those who expressed scepticism about the real estate bubble were often flamed and accused of sour grape syndrome. Now many of those “optimists” are lining up for help – courtesy of the taxpayer – even if doled out by the banks.

In my neck of woods in BC I see properties which several months ago listed at mid $800,000’s still on the market at, wait for this, under $500,000 and no takers. I would be irritated were our federal or provincial governments – or for that matter Canadian financial institutions – to borrow a page from the US. After all, just as one cannot eat or live in a bar of gold (I‘m borrowing a thought from a wise person I read frequently), he cannot eat or live in a second or third house.

We should not forget that the parties involved (lending institutions, buyers, flippers and speculators) on both sides of the border have contributed to creating an unsustainable pricing environment where young families could not afford detached dwellings. It would be only fair to now allow this market some freefall so that those who were previously deprived of buying opportunities could capitalize. Their children, I am sure, would enjoy playing in their own backyards for a change.

And for the record, I am trying real hard to stay objective on this. Freefalling real estate market would sure damage my own bottom line.

Best regards,

Marcus

PS

October 20 edition of Business Week has a good story: “The Plastic Storm” Subtitle reads “Toxic credit-card debt looks like the next disaster for financial companies.” I await the next wave of bail outs for the banks, and by extension, for the delinquent borrowers. I submit that if 19.5 percent interest rate was not a deterrent for them, nothing ever will be. Taxpayer, would you kindly empty your pockets:)