As long-always automatons serve us up the same old buy and hold oatmeal, I think it is helpful to cut through the noise of quarterly and yearly return reports and look at some real life dollars.

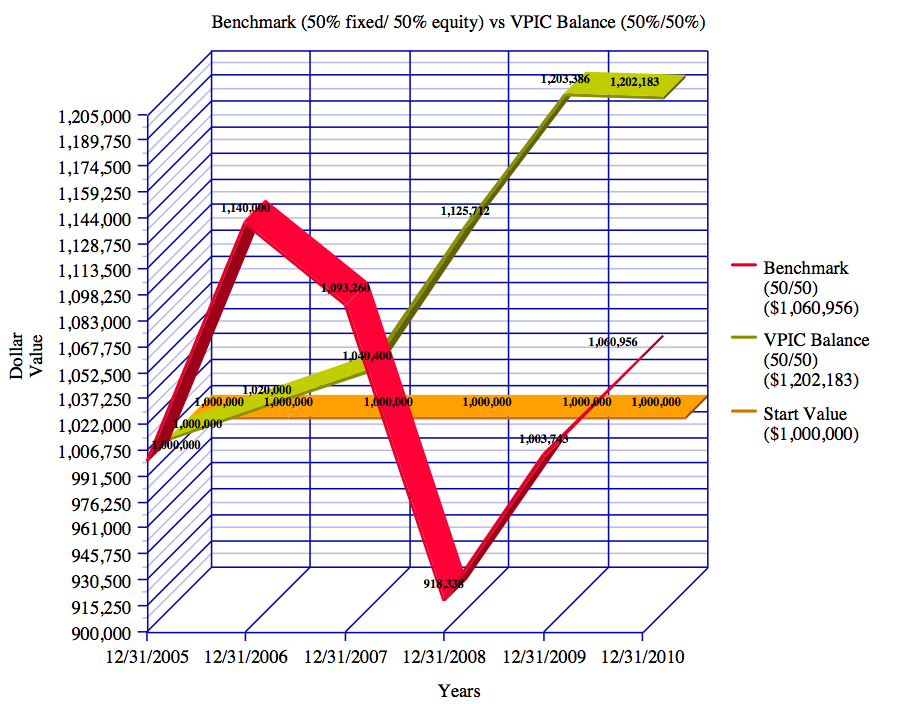

This 3D chart paints the big picture over the pixels, and plots buy and hold returns for a balanced account (red) over the past 5 years ended December 2010.

It shows that if you took a million dollars to a typical investment service–broker, planner or investment counsel–5 years ago at the end of 2005, and they allocated your capital to a conventional mix of 50% bonds and 50% equities, and kept you fully invested in that mix to the end of 2010, you would have just barely broken back above your starting deposit value near the end of last year. And that is only if they did not charge you any fees for their service.

If you paid anywhere near the standard 1 to 2% a year fee, your net returns would be negative over 5 years. Quite a value add. In the meantime you have suffered through horrendous risk, and probably much angst and mental suffering for your trouble. Most people when faced with negative returns like 2007 to 2009, bail out near the bottom. But if you took the average advisors “advice” and “stayed the course” throughout, you would still have failed miserably in plans of advancing your capital puck down the ice.

It is simply nonsense to say that this is the only reasonable course. It has been an extremely volatile market period over the past 5 years to be sure. (Actually over the past 11 years where the numbers actually look worse than above, but few people seem to be counting.) It has been hard to make and keep returns, but it has not been impossible. The green bar on the above chart shows the actual returns which my firm has been able to generate on a one million dollar account over the same 5 year period, and this is net of all fees. This is not meant to brag, we are humble folks. The annual returns may seem modest, but avoiding or minimizing losses, is far more important to the net dollars than riding the wild ride of the stock market every step of the way. What about all that talk about more return for more risk? If you had been more aggressive and allocated more than 50% to equities over the past 11 years in a typical approach, your returns would be even more negative. And that is just to the end of 2010.

To add insult to injury, 6 months into 2011, investment returns are once again negative year to date for the buy and holders. And the market downturn the past 7 weeks has so far been quite modest. Just imagine how red cumulative returns will look at the end of the next big cyclical sell off.

I have no idea how conventional financial advisors are finding the nerve to keep serving the same old gruel here. Deep down the honest ones must be feeling like frauds. How long their clients continue to eat from their spoon remains to be seen. I think many people think changing the advisor changes the recipe; sadly few realize that 95% of the service providers today cook from the same Modern Portfolio Theory book.

None of us get to pick the investment climate we find ourselves in, but facing facts, we do get to chose how best to navigate our way through it.