One of the tag lines I have seen with increasing frequency from investment types the past few weeks is “this is not 2008.” I can understand this hope.

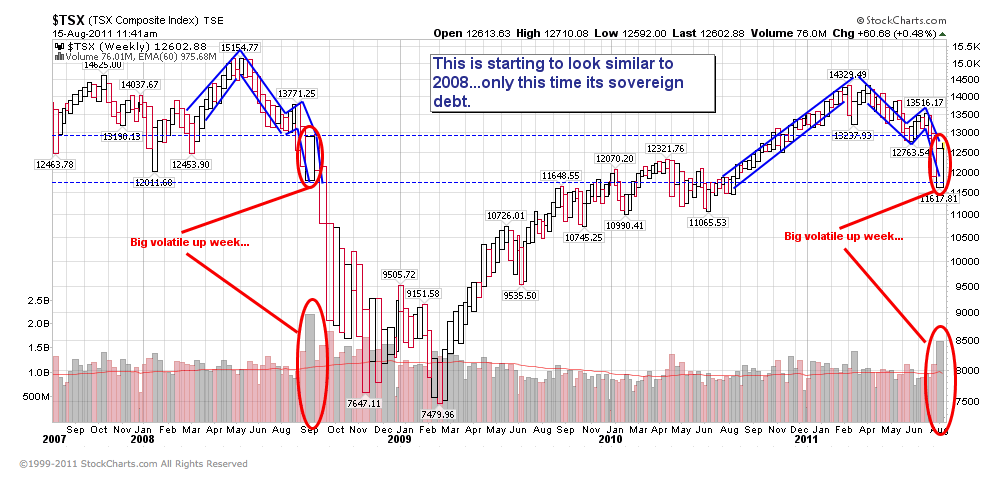

If I was a money manager, or commentator who had been recommending long-always, passive allocations to equities through now 11 years of cumulative market losses, I suppose I too would be very resistant to the probability that we have now started into the next cyclical decline in our ongoing secular bear market. A tendency to ignore reality and probable outcomes however can be extremely hazardous to one’s financial health. Ready or not, history warns us that the next cyclical decline during the next recession is likely close at hand and may take back most or all of the price gains made in stocks since they last bottomed in March 2009. The following update from my partner Cory Venable this morning reminds us of what that could look like for the Canadian TSX.

I agree we are no longer in the world of 2008. Unfortunately I think there is even more risk in world markets today than there was back then. Then the global recession was prompted by a bursting credit bubble in the US and related bubbles in asset markets that excess credit had created all over the world. But after three years of stepping in to “save” asset prices and bubble makers, and facing still falling tax revenues, most governments and central banks today are in worse financial shape than they were in 2008. Today we have more credit in our system, not less.

Most of the millions who have been unemployed or underemployed the past few years have eaten through any savings or equity that they may have started with. Those who could continue to borrow have done their level best. Canadians have been real troopers for the global recovery bid, now significantly more indebted than they were 3 years ago. Canadian debt to disposable income ratio is now at a record 147% and our housing market has not corrected but advanced further from the bubble peaks of 2008.

At this rate, it is possible the world may look back at 2008 as a relatively easier time than the next recession we are entering. Like a winter that comes too hard and fast, there are less provisions in the cold cellar this time around.

Please at least consider this possibility in your financial plans. If you have no more defensive plans or strategy this time than you did in 2000 or 2007, please understand that you have a perilous hole in your risk management approach. Hope for the best by all means, but make sure you have a plan for the probable.

I see the warnings of the global market entering another recession, but what defense can we take?

Equites – no, bonds – no, balanced portfolio – no…. etc

What’s left? Liquify our investments and take the tax hit? What do we do with our money then? I’m at a loss as to the action to take though I see the oncoming slaughter.