Technician Cory provides this updated look at the Canadian TSX composite as a barometer for the global risk trade and notes that since the peak last March, each interim rally has failed at previous resistance and broken lower. This is called a continuation pattern in geek speak, and so far confirms the dominant market trend remains down. The current rally’s hope for Obama’s job plan on Thursday (the Republicans have already said they will block it) or Bernanke’s speech on Friday, could continue for a while longer with the next significant test around the 12,850 to 13,200 area marked below.

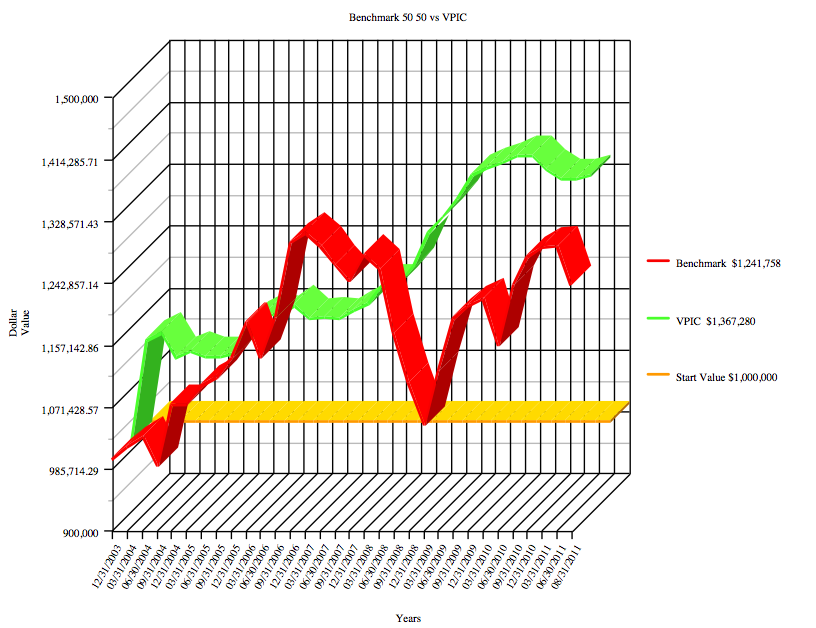

Meanwhile more on why tactical market timing over passive allocation is crucial to progress in a secular bear. Here is the latest update on the progress of 1 million dollars in a typical 50% equities, 50% fixed income benchmark (without taking into account any management fees paid) from 2003 to the end of August 2011 (red) versus with our firm Venable Park (green, net after all fees and HST).

We would always like to make more, but we have to drive in the conditions we are given. In a secular bear, asset deflation environment, slow and steady wins this race with higher cumulative returns while putting our capital through about a third of the volatility and risk of a traditional allocation approach.

Industry data suggests that most investors have actually fared much worse than the 50/50 benchmark over the past 8 years. But it is enlightening to note that even those who managed to match the benchmark before fees are now only back where they started in 2006, with no nominal, real or net gains for more than 5 years. Over 11 years, their results look even worse. But, hey I know, most long-always types don’t trouble themselves with actual counting.