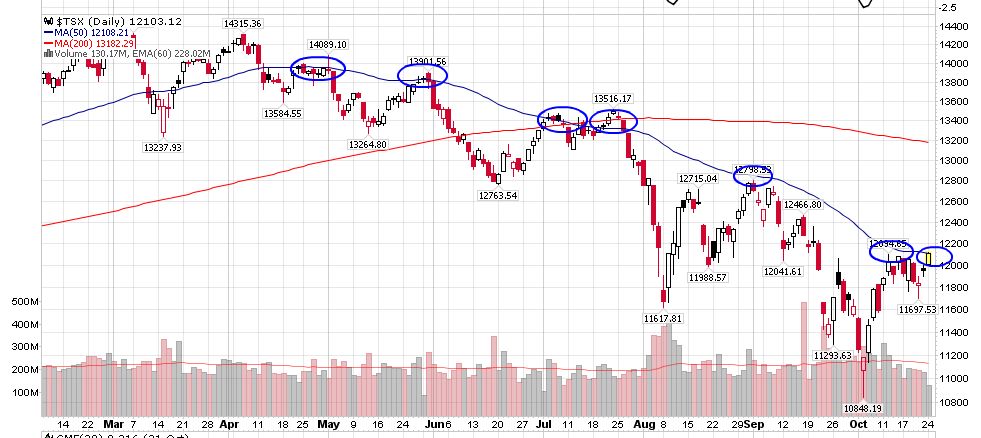

The TSX is moving back toward resistance on this latest rally. If only the recession was priced in already…sadly, markets have never made a lasting bottom until after the recession has been confirmed in retrospect. This time different??

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

It now looks likely that the Euro zone may have officially slipped into recession in the third quarter. Today’s Flash Markit Eurozone Services Purchasing Managers’ Index (PMI) – measuring business activity at thousands of firms from banks to restaurants – fell to 47.2 this month from 48.8 in September, well below a consensus of 48.5 from economists surveyed by Reuters.

The euro zone’s manufacturing PMI fell to 47.3 in October, its lowest level since July 2009, with German manufacturing falling for the first time in two years because of a combination of drops in output and new orders and backlogs of work. See: Euro Zone “Miserable” PMI heightens recession risk.

Yes. Unreal. Isn’t it? Some stocks even break their 52 weeks highs today. Love the chart. Many thanks, Mr. Venable. JW, Vancouver

Speaking of retrospect (2008), here is a good reminder from ECRI:

http://www.businesscycle.com/news_events/event_details/1490

Bears not in control just yet……the longer this holds above the 50 dma the more likely it will become a buy the dip market ….we will see what happens out of Europe…..but looks like Gold is giving us the answer a little before the event….so final capitulation extended to 2013??

Maybe there will be no final capitulation….. no bell at the bottom …. just a very slow….sideways grind until all the deleveraging needed has worked it’s way out of the system??

More scary stuff….

http://www.zerohedge.com/news/guest-post-market-rally-real-thing-or-just-more-perception-management