Two charts worth noting today. One courtesy of John Williams via John Hussman showing the dramatic decline in the hard-to-fudge totals for Federal Withholding Tax deposits over the past six months. Whereas payroll earnings numbers have improved over the past year, they are heavily guesstimated based upon BLS assumptions which are usually revised in retrospect. Tax receipts on the other hand, are cash in hand and are typically a much more accurate reflection of reality. This chart suggest that official estimates of payroll and earnings have been overstated the past 6 months and are likely to be revised lower shortly. More evidence that the US economy is weakening faster than some official data suggests.

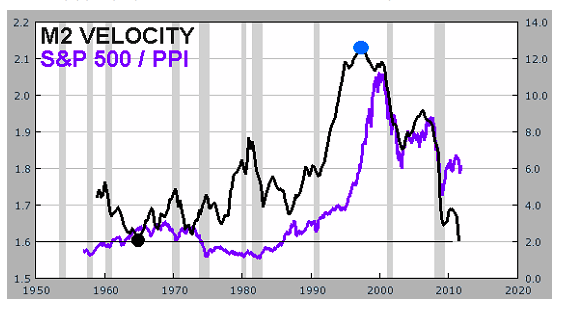

And the other (courtesy of Zerohedge) showing the ongoing contraction in the US M2 Money Velocity (shown in black–money moving through the economy) and the ominous spread which is now gaping beneath the current price level for the S&P 500 (purple line). This space is likely to close with a further decline in the price of stocks over the next few months.

And the other (courtesy of Zerohedge) showing the ongoing contraction in the US M2 Money Velocity (shown in black–money moving through the economy) and the ominous spread which is now gaping beneath the current price level for the S&P 500 (purple line). This space is likely to close with a further decline in the price of stocks over the next few months.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

Buying Dividend Yield is Not Defensive, its Stupid

http://www.zerohedge.com/contributed/buying-dividend-yield-not-defensive-its-stupid

Another ‘tax receipt’ drop coming soon…our wonderful up-scale Oak Brook Center shopping mall in IL is losing yet another fine store due to the Economic Slowdown.

They sell rather expensive finely done photographs of nature, wild animals etc. They are selling everything 50% plus…seems the ever-rising rents ($15,000 per month for a small front) and the ever-decreasing ability of clients to spend such princely sums has exacted yet another toll on ‘receipts’. So add 6 direct salaries plus who knows how much support salaries to the ever-growing pile of reduced taxes paid and newly-minted unemployed people to the Bears Inferno. But the great news is I picked up a wonderful photograph of a lynx on the hunt in Denali National Park for a song!

Yep, this deflation is a wonderful thing…for a while I suppose.

Ms./Mrs. Park,

Could you explain the words “Federal Witholding Tax Deposits”” ? Being from Europe and speaking a different language, I am not familiar with the (precise) meaning of these words. I regularly visit the Shadowstats website and I must say Mr. Williams has a more sober look on the numbers the US government is churning out.

BTW: When (not if) both Europe and China are going down the drain then the US WILL feel the impact as well. This will result in a shrinking US Current Account Deficit and a shrinking US Trade Deficit (commodity prices x demand). And because the USD is the world’s reserve currency those two shrinking deficits WILL – contrary to common belief – make financing the US budget deficit much much harder (impossible ??) in the coming future, especially at a time the US federal budget deficit is at a staggering $ 1.5 trillion. And I expect that deficit to widen in the future. Just imagine what would happen when those two US Deficits (Trade & Current Account) would turn into Surplusses …………… (rising US interest rates, anyone ??).

And this will hurt Canada as well because about 70%/75% of canadian exports are going to the neighbour south of Canada. It’s, as Mr. Bob Hoye would put it, “”All One Market”” (AOM). Not a “”pretty”” picture.