Media today is all abuzz about the FACEBOOK IPO!!!!! They want to know: what do I think?

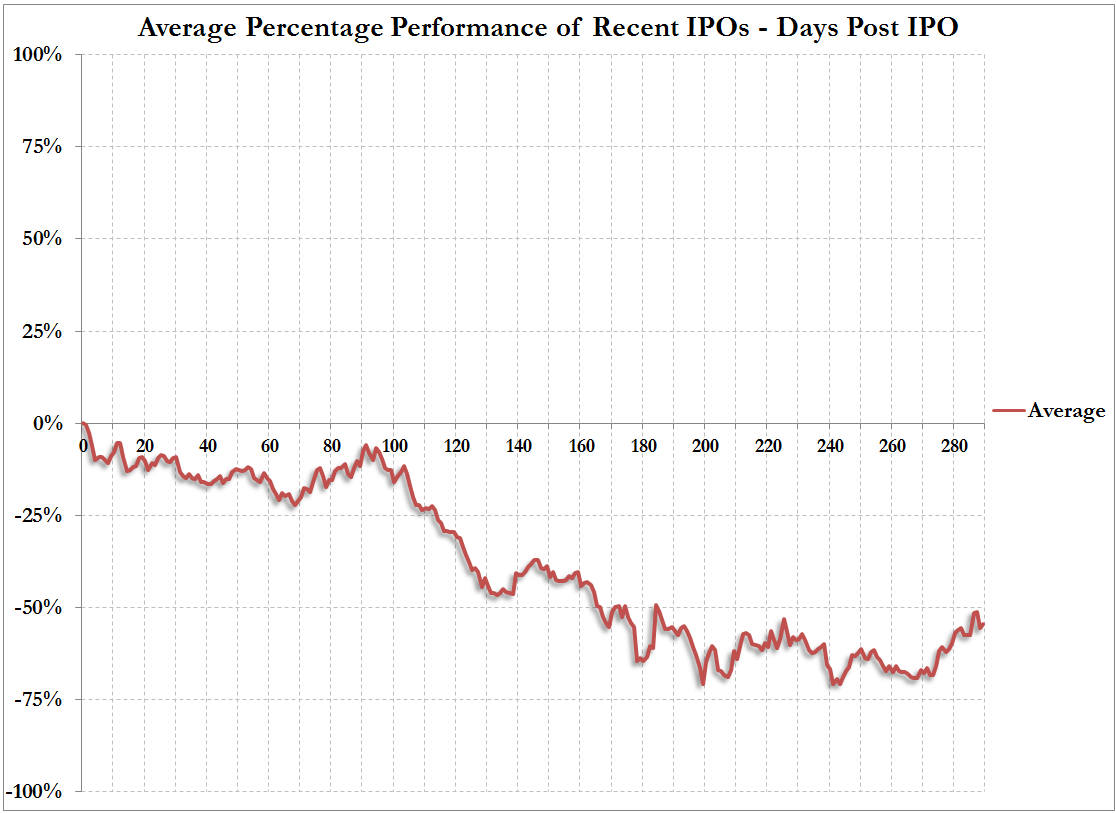

These two charts from Zerohedge of the 8 most touted internet IPO’s in the past year or so, reiterates my thoughts on new issues pretty well. The group includes GRPN, ZNGA, LNKD, P, YOKU, DANG, AWAY, and FFN. The first charts the average return of the group over the following 12 months from the issue date: -54%:

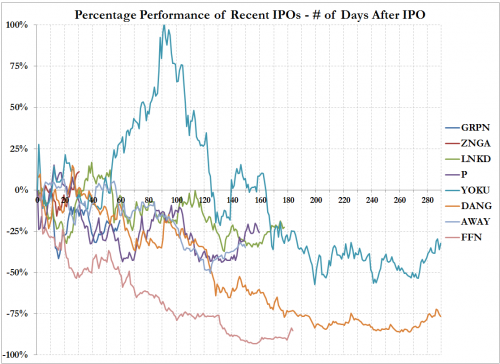

The second shows the individual price performance of the issues from day one:

And of course there was the Sprott IPO which I already discussed here last week.

Yes, yes, Google was a bit of an outlier, it went way, way up and then way, way down and now is at the level it first reached in 2007. Timing or blind luck matters a ton in this stuff. But generally, IPO dogs don’t hunt for initial dupes “investors”.

Danielle, if all IPO’s are dirt, why not short the crap out of them?

I bought GOOG right after the IPO came out at 85. I paid 112.00 AFTER it made its first initial-pop base, like I trained to from IBD’s Wm. O’Neil. Google was already making money–a proven hitter. The issues listed above are not proven hitters, and they certainly aren’t making the kind of revenues Google had already put up on the scoreboard.

And I will treat FACE like any other internet stock. It had better have GREAT earnings or I’ll pass on it. We only have so much capital to deploy and the market has to be in a confirmed uptrend.

google had a strong ipo but i am suspicious of facebooks business model. seems like the dot com thing repeated. i only use facebook to chat with friends and i use the adblock plus add on for firefox to completely eliminate annoying ads on the right side of their page. So they are not making a nickel off of me using their. I suspect many others do the same thing.

Right Dave. Right now the revenue streams are not totally known or understood, at least not by me. I understand how Chipotle CMG makes their money….selling standardized burritos in a cookie cutter pattern over and over and they are expanding at a nice steady rate. Even globally with London and Paris openings. Anywhere you go you get the same taste and flavor of the burritos, something that cannot be said for mom and pop burrito stands. Ever remember getting a bad plate of Mexican food? And they are trying to diversify into Panda Express-land with healthy, non MSG foods. This concept I can understand and the kickers are they were incubated by McDonalds and have an extremely low number of shares: 30,000,000. The price proves the point.

But with FB, I don’t quite know what the end drivers for revenue are going to be. With Google I did, and look how they created new revenue streams.

I will watch Facebook be born, and watch it for a valid price entry point. It had better have a good market to springboard upon, and that may be its fiercest headwind.

Perpetual growth?

http://fallenfromgrace.net/2012/02/01/the-myth-of-continual-growth-and-a-future-shaped-by-global-climate-change/

Whoever suggested LNKD, thank you! It actually looked pretty interesting and I bought some. Sales doing well, estimates are positive, PE is awful and RS is low but it looks like a double bottom base. I’m in.