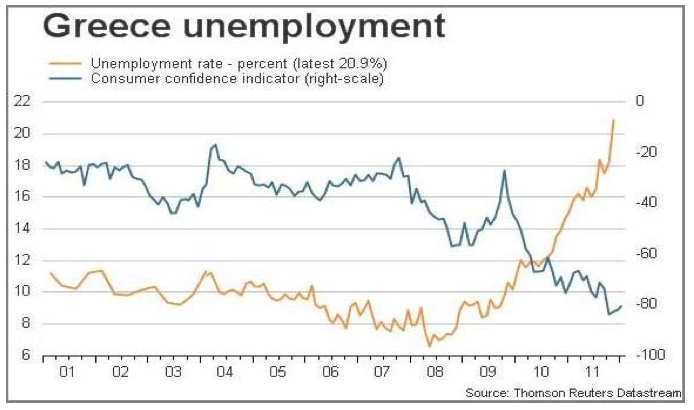

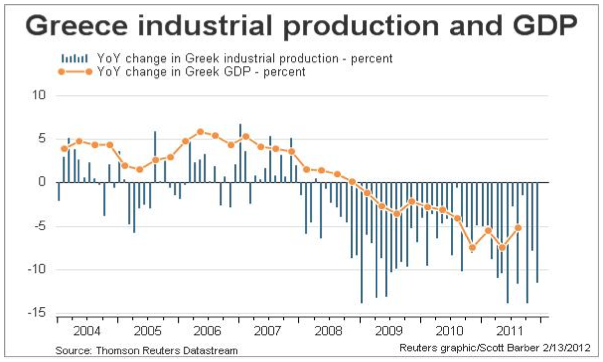

Five years into recession, with unemployment at 20.9% (as of November) and 48% of those under 25 unable to find work, the ongoing decimation of the Greek economy is agony to witness. Today, stocks rallied back from the lows of the day (same three guys trading no volume) in the final 30 minutes on rumors (again) that politicians have agreed to the next round of austerity. There is no way this new plan is going to last. All of this is a farce– math that doesn’t work, doesn’t work no matter who you threaten. The next general election is set for April. This is getting down right sadistic.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

The worst stat that I heard was last year the suicide rate went up 40%. It would indicate the real effect of these conditions on real people living real lives.

The solution for Greece is in their past. Time for Solon’s Seisachtheia!

http://en.wikipedia.org/wiki/Seisachtheia

I saw this ad in a German magazine recently:

Please, adopt one Greek for 500 euro.

This adoption would be a very good decision because the Greek would do everything what you would not have time for, like sleeping until 11 am., having a coffee and siesta again right after.

Greece is really a nice place to visit, actually. Great history, climate, food. Whats not to like? Just stay out of the cities and you’ll be ‘just fine’.

Its a great lesson if you want to see what the United States of America will look like if we don’t take care of our problems, although it couldn’t possibly get ‘that bad’.

Being the first nation in Europe to go through bankruptcy could be good for Greece, long-term.

Look at the experience of the U.S. airline industry. Airlines that went through bankruptcy shaved debt, cut costs, and had expensive union contracts reworked. They emerged leaner and meaner, and were able to outcompete the airlines that didn’t go through bankruptcy. Because all the airlines were in poor financial shape to start with, the ones that went into bankruptcy first end up doing much better.

If Greece learns from their experience, they could be outcompeting France, Spain, and Britain 10 years from now. If not, well, this will continue…