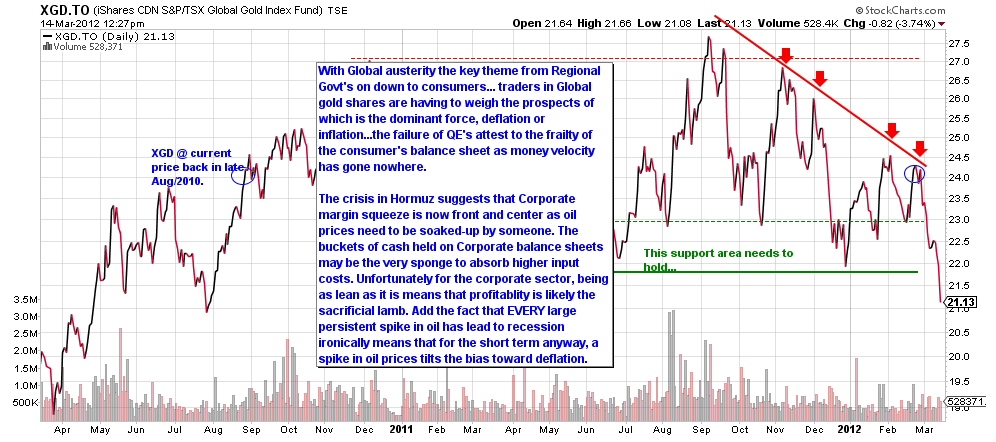

As Gold companies trade down with other commodities and stocks this morning, we note key support around 21.70 for the XGD (Cdn gold co ETF) has now been broken to the downside with the index back below 21. Down now more than 24% since September, and below August 2010 levels, those believing gold co’s are a safe-haven are learning a tough lesson once more. This chart was updated last week on March 14, we are now below the green support line noted.

Cory Venable, CMT, Venable Park Investment Counsel Inc.

Cory Venable, CMT, Venable Park Investment Counsel Inc.

Anything priced relative to itself may not really be that important. How you measure that drop or increase relative to something else can be quite telling. Gold stocks have had a decline recently but relative to bullion they are cheap…no! Well there is another scenario worth mentioning . If you think gold stocks are cheap, and they appear to be, then you have to believe Gold will be stable. Are they telling you Gold has a way to drop yet?

But Bernank and the boyz have swore to stop deflation at all costs. If that means $200 oil and $2350 Gold ….oh well… we can just blame the speculators. So any sign the markets will drop the PPT will be summoned then the Bernank will make a special presentation or leak this thoughts to the favourite sycophant Wall Paper and the next round of QE will be on. Que the cheerleaders please….strike up the band.