John Taylor offers a cogent wake up plea to Americans and the Federal Reserve in today’s Wall Street Journal:

“It is difficult to overstate the extraordinary nature of the recent interventions, even if you ignore actions during the 2008 panic, including the Bear Stearns and AIG bailouts, and consider only the subsequent two rounds of “quantitative easing” (QE1 and QE2)—the large-scale purchases of mortgage-backed securities and longer-term Treasurys.

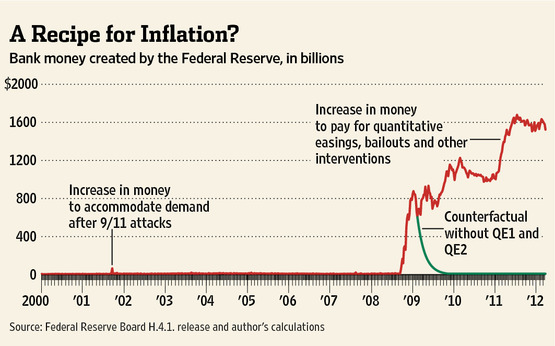

The Fed’s discretion is now virtually unlimited. To pay for mortgages and other large-scale securities purchases, all it has to do is credit banks with electronic deposits—called reserve balances or bank money. The result is the explosion of bank money (as shown in the nearby chart), which now dwarfs the Fed’s emergency response to the 9/11 attacks.

Before the 2008 panic, reserve balances were about $10 billion. By the end of 2011 they were about $1,600 billion. If the Fed had stopped with the emergency responses of the 2008 panic, instead of embarking on QE1 and QE2, reserve balances would now be normal.

This large expansion of bank money creates risks…” Read the whole article here.

The chart above offers an important perspective on the size of the mind-boggling cash infusions to date via the Fed. And highlights the extremely important question of how one agency can be allowed to wield such unfettered discretion at the expense of all the principles of democracy and capitalism upon which America was founded. How does this serve the best interests of the masses? Clearly these policies are madness and cannot go on indefinitely and yet how in the world does this end??

“[H]ow in the world does this end??”

Uuh… hyperinflation?