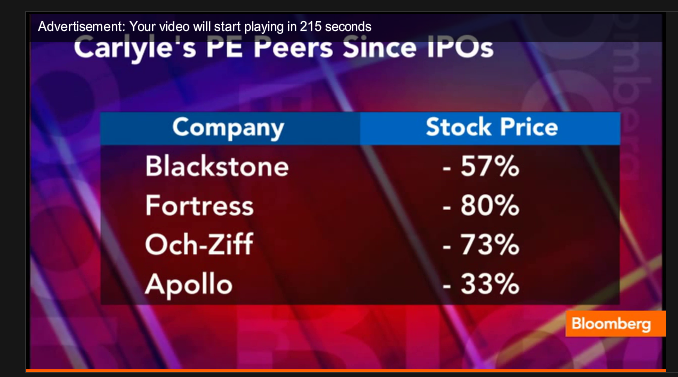

Private equity firm Carlyle Group LP went public today raising $671 million in its initial public offering and making its three founding partners billionaires. The issue was priced below the marketed range however, after struggling to win investors wary of the track record of publicly traded buyout firms. More evidence of the investor dupe of IPO’s can be found in considering the after-IPO performance of some of the other much-hyped deals sold to the public over the past few years as shown below. Typically sellers and their broker/promoters get big bucks while investors get big hype and big hurt. See Carlyle Prices IPO Below Range.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In