Two chart updates today worth considering. This first one shows 10 Treasury yields continuing to fall as money flows to strategic ‘risk-off’ mode parking in the relative liquidity of US Treasuries.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

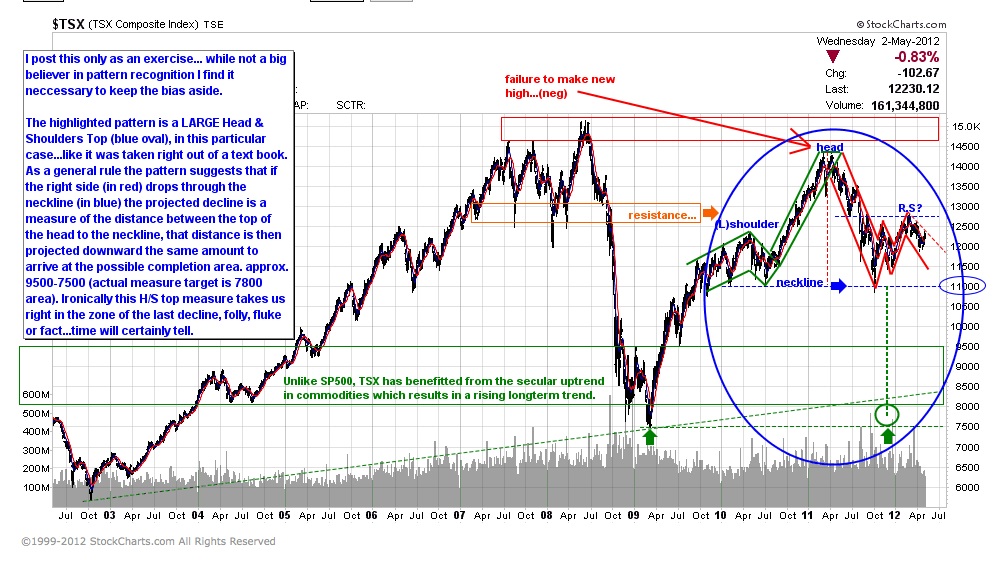

Another big picture snapshot of the Canadian stock market confirms this trend, with capital continuing to flow out of the ‘risk on’ global-growth bet.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Danielle,

I’m familiar with the debate over how much actual control the Fed has. Even Greenspan once admitted the bond market is really in control. (Of course anything he says is an expedient and can’t be trusted, even if what he says might be true.)

But are you saying that there is no correlation between bond prices and Fed monetary policy? Or is the correlation the opposite of what most think? I would think the Fed would want to stoke demand for Treasurys as a way to support the dollar and keep rates low. Also, doesn’t the effect of Fed policy largely depend on where on the yield curve you are looking?

The correlation is the opposite of what most people think. The Fed says they do QE and op twist to support bonds and lower rates, in fact the opposite has happened at each announcement. They roll out another round of stimulus and bonds fall. When they come to the end of each program bonds rise. We suspect this may be because bond markets see the slowing global growth and further asset deflation ahead.

What I would really like to know is: are the Feds efforts simply ineffective, or are they operating according to an agenda that is different from what they publish?

Without delving into the conspiratorial, I view the Fed primarily as a banking cartel, given that the large commercial banks own the Fed banks. Cartels are formed to protect the interests of their members, mainly via price fixing. Therefore, it would make sense that the Fed’s primary goal is to protect the interests of “Wall Street” by fixing the price of money in such a way that benefits them the most.

That’s not to say they wish to do harm to the people, it’s just that the people’s interests are secondary (if they matter at all outside of how this affects the banks). Actions taken in 2008/09 would certainly support this view. And if we look back into history, Paul Volcker’s actions to stop inflation and save the bond market by killing the economy and driving down wages offers more evidence of same.

FWIW: Investors Business Daily throws in the towel and declares the uptrend created by AAPL’s earnings on April 23 is UNDER PRESSURE. Too many distribution days in a row. It pays to watch the undercurrents beneath the waves overhead. Sell in May always seems to work. Less cash flows into the markets post taxday. And the bosses are prepping for their summer breaks and beach homes. Who wants to worry about the markets when the kids are having a good time? Nothing makes a trader more upset than collapsing portfolios. Cash is never trash. Rich of poor, its good to have a lot of cash.