The usual parade of clueless commentators are scrambling to explain the ongoing plunge in risk assets worldwide. One of today’s “shocker” headlines is captured in the below clip: “Crude oil futures extended declines after the U.S. Energy Department said stockpiles rose to a 22 year high”.

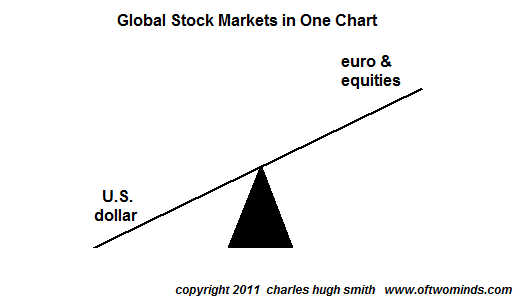

The global downturn is slowing world demand just as rising production continues to swamp the glut. (Remember all that (over) investment in the oil and commodities space during the past decade?) As Euro stress escalates and the global recession advances, the risk off teeter totter favors cash, the US dollar and treasuries over risk-credit, commodities and stocks. Remember this image to help understand present dynamics. It is precisely the pattern we have seen in previous bear markets.

Hell in America

http://www.theburningplatform.com/?p=30603

Has anyone else had trouble downloading this video on oil? I have tried many times, but I just can’t get this video.