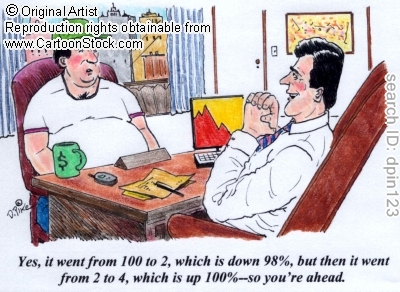

A client sent me this cartoon. Funny. But also very common to hear this kind of nonsense math from many financial types and “stock-pickers”. When they talk confidently enough… some people actually seem to believe them.

Follow

____________________________

Cory’s Chart Corner

Load MoreWow...RBC trying hard to obfuscate an 8x growth in loan losses with candy for the kiddies, buybacks and dividend hike. Morning other Danielle...

h/t @DiMartinoBoothDanielle DiMartino Booth @DiMartinoBoothBattening down the hatches with an eight-fold hike in loan loss provisions north of the border:

@RBC provisions for performing loans totaled C$568 million in the second quarter, up from C$68 million in the first three months of the fiscal year.

@business____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

After watching the piece with El-Erian from PIMCO, and seeing this cartoon….I am going to go off the cliff and state, and you can quote me on it…that QE is coming much sooner than anyone is expecting, possibly by the end of this month (June).

How can it not in a credit-based banking system? And the folks calling for deflation-driven gold through the floor boards had better cover their shorts. Fridays gold move was a pocket-pivot, not ‘just short-covering’…it was FEAR. Real FEAR. $ 2,500.00 gold is coming, mark my words. Anyone who can’t understand this are out of touch with reality, IMHO.

Reminds me a popular female financial whizzard with initials S.O. asking her audience this question:

Which is better:

a) An investment that goes up 80% one year and down 50% the next, or

b) An investment that goes up 5% each year.

She did the math given a $10,000 investment in each:

Investment a) First year you would have 18,000; second year you’d have 9,000.

Investment b) First year you would have 10,500; second year you’d have11,025.

Problem is, where can you get 5% today?

Actually, you can get about 5% in preferred shares, but of course there is capital risk, as well as other risks depending on the type of preferred shares you are buying. As always, understand what you are buying BEFORE you buy.

You can also get 4-5% in investment properties (low by historical standards), but RE is manic right now.

Be careful.