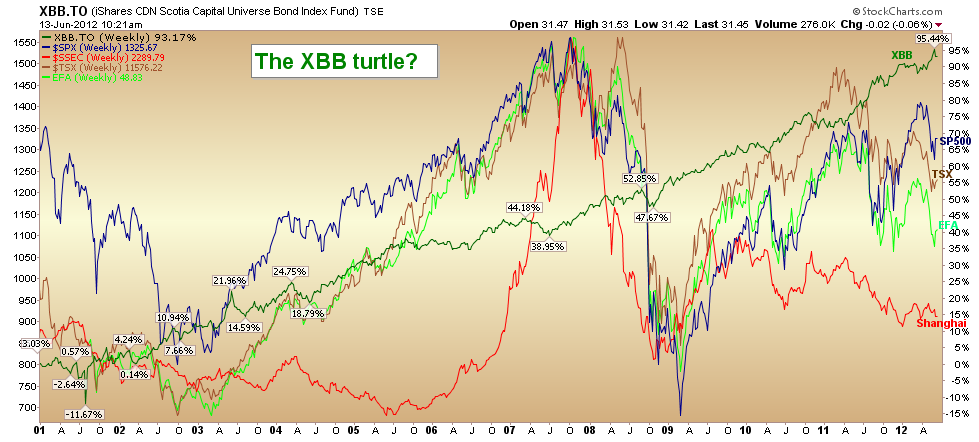

As risk sellers press their typical taunts urging people into their equity and “growth” based (higher fee) products, loss-averse turtles who have taken a fraction of the capital risk over the past 12 years have quietly, humbly, lapped the hares and slept at night. The chart below plots the XBB (top line), a Canadian bond ETF that tracks the DEX index of investment grade Canadian bonds as against major global equity indices (S&P 500, TSX, EFA, and Shanghai comp) since 2000 when our secular bear in stocks began. Proving yet again that risk is not rewarding when bought at too high a price, and slow and steady has handily won the day. Boring old bonds indeed…

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

Yes Bond Bunnies are looking pretty schmart these days. Mom and Pop taking notice now and bailing in at unsustainable price levels. Other charts you may want to compare your bond chart to are real estate, consumer staples and most other hard assets. Hard assets and food and shelter have far eclipsed the rising price of bonds. People will always require food shelter and energy and will always happily trade their paper bonds for it.

What is a bond….ink on paper…..almost always subordinated….and in the end really just a puff of smoke.

Now what do you do for an encore?

Isn’t the bond duration of this ETF a bit risky? A bond with a duration of six years would be expected to fall 6% in price for every 1% increase in market interest rates (this ETFs duration is 6.84)

nothing is buy and hold in this market, and yes duration will need to be shortened when we finally get to a rising rate environment. But duration of 6 is a whole lot better than a duration of 60 on the S&P at this point.

So I guess considering all the censorious commentary directed to The Bernank he has been good to you as well as the “risk takers”.

I think it is getting very close to the time when the vigilante’s start rounding up the bunnies and sending them back to the briar patch.

Talk about risk on. Give a person a piece of paper promising to give back the principal and a little bit of interest at some point in the future. No guarantees mind you, nothing backing the promise, just the good word. Of course if circumstances dictate that the debt cannot be repaid. Then it’s oh well just too bad so sad you lose.

However for those with the tenacity to stick with long bonds I say good on ya…you have done well….now lets read the next chapter.

Maybe overlay the price of gold and see if the Turtle wins? Hmmm?

Bonds can, and have, changed price in what is called a “jump condition”.

However sovereign bonds, especially A rated, are the basis of trust and confidence underlying our economic and financial system. That is why it is so serious to “restructure” debt because it is really a default – a broken promise.

There will be a time to stop owning bonds but be wary of selling too early even with the large inflows into bond funds as retail follows the herd. Yields can also stay low for very long times.

I like the way Danielle and Cory look at risk as ratios such as TLT:FXC to gauge risk.

A fly in the ointment is tacit, not overt, central bank policy to inflate – confuses the situation immensely and subsidizes debtors.

http://screencast.com/t/Picim9h0