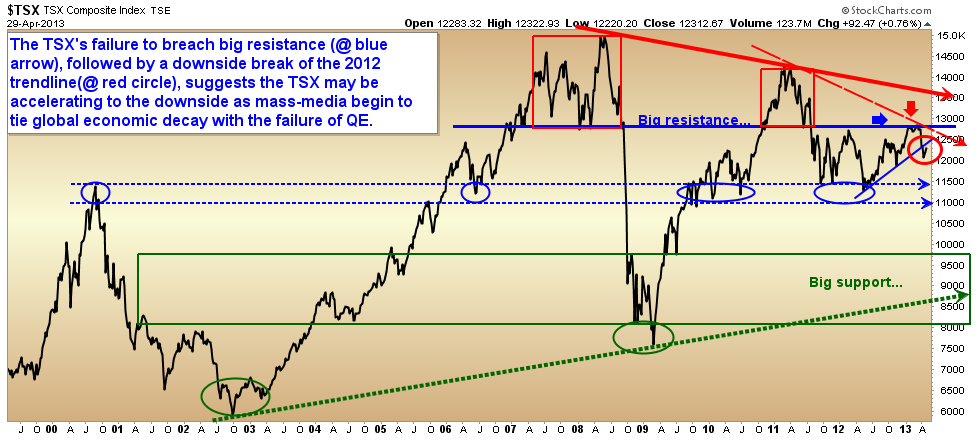

The US dollar has weakened off today which may reflect a belief that this morning’s US recession warning from the Chicago PMI at 49 will prompt even more “support” from the Fed. The Canadian dollar has rebounded a bit the past 2 days in hopes that more stimulus will lead to more growth? or inflation? or BOC rate hikes? Not likely; 5 years of monetary mayhem haven’t delivered so far. Treasuries remain unconvinced with the US 10 year yield hovering slightly down on the day at 1.67. One thing for sure, the Canadian TSX composite is not looking strong here, as prices and buyers continue to retrench with the global economy.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.

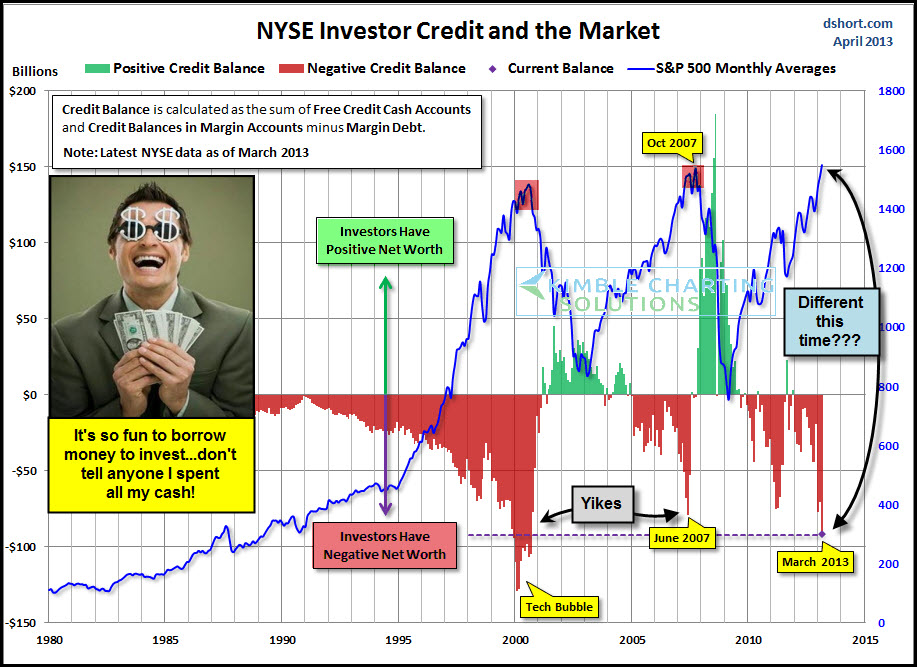

Meanwhile, the S&P 500 is looking positively crack-whacked with QE tortured pricing, poor participation and highly levered traders gunning for the sky. Jeremy Siegel must be right this time, what could possibly go wrong here??