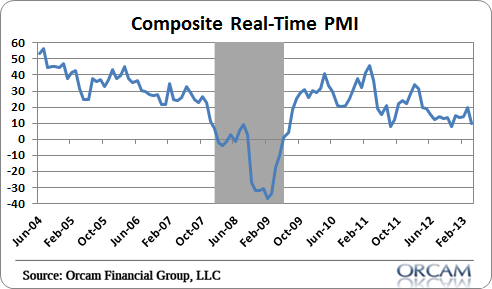

Global PMI Manufacturing has been in a pronounced downtrend since 2010 regardless of manic liquidity injections from Central Banks. Today we learned that Canadian Manufacturing continued its flat line in April at 50.1 after 49.3 in March (below 50 being an indication of official contraction), 50.6 in China, 36.7 in Australia! Below we see a portrait of US PMI Manufacturing since 2004, which came in today at a barely beating 50.7 in April from 51.3 in March.

This lends support to a US recessionary reading coming from Nominal GDP which in Q1 came in at 3.4%. Readings below 3.7% on nominal US GDP have only been seen in recessions, and Q1 was the second quarter in a row of this indication of economic contraction.

I know, none of this matters because the Fed has our back…right. The 60 trillion dollar global economy is falling backwards at increasing velocity (despite 5 years of Central Bank antics) and Ben and his academic buds are promising to catch our fall. Why worry?

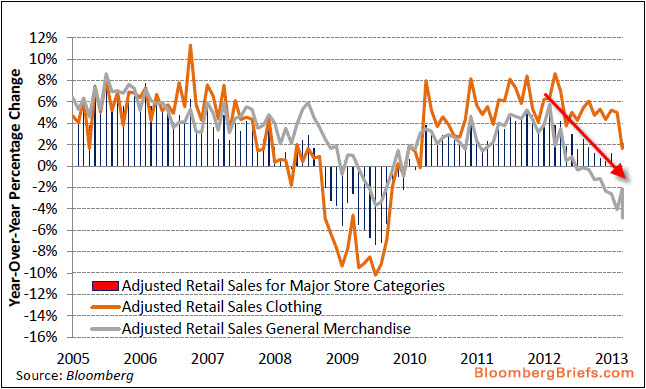

Here is another useful glimpse at the 70% consumer-driven US economy. Retail sales collapsing since 2012 like they did in 2008. But, who needs customers, right?

<

<