“Steve Eisman, the hedge fund manager who famously bet against mortgages in the United States in the run up to the 2008 financial crash, has recommended investors now bet against Canada’s mortgage lenders and banks.

Eisman, founder and portfolio manager of hedge fund Emrys Partners, rose to prominence with subprime mortgage bets that were chronicled by Michael Lewis in the book “Big Short”…

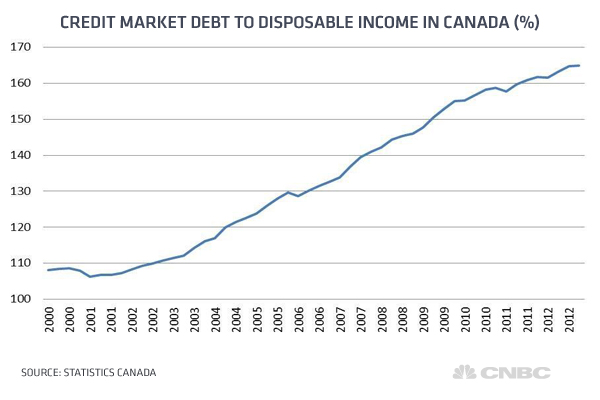

Fears remain that Canadians aren’t listening as the ratio of credit market debt (such as mortgages) to disposable income continues to rise, according to Statistics Canada, reaching 165.0 percent in the last quarter, compared with 164.7 percent in the previous.” See: Canada’s housing market: the next big short?

Canadian home prices have doubled over the past 10 years (7% price appreciation per year), a rate of growth some 40% above the 5% a year long term average since 1980: “Canada is a commodity producer, and commodities have done very well in the past decade, so, in part, strong price gains in Canadian real estate might be a side effect” says Stein. A side effect that is due for a correction with the on-going global downturn in global commodity demand.