An article in the Globe and Mail on Thurs underlines a key point perpetually overlooked in financial commentary. The Canadian Pension Plan Investment Board (CPPIB) announced that it was able to make a 10% return in 2012 (gross before all management fees and expenses) thanks to the late year rebound in foreign stock and bond holdings. See: CPP fund returns top 10 percent

“The chief actuary of Canada has affirmed that the CPPIB is sustainable over the next 75 years if it earns an average of 4 per cent real annual returns after inflation. CPPIB said Thursday its 10-year real rate of return after inflation is 5.5 per cent, while it’s five-year rate of return is just 2.4 per cent, due mostly to large losses in fiscal 2009 when financial markets collapsed and CPPIB posted a 19-per-cent loss for the year [my bold added].”

A couple of crucial points here. First of all as a continually funded plan on a monthly basis from all Canadian workers, the CPPIB can afford to assume a multi-decade long investment horizon–and it does. CEO Wiseman said CPPIB plans to become a public advocate for long-term investing around the globe, saying funds like CPPIB have a “natural multi-generational nature”. And they do. Individuals however do not; and this is the meat of the challenge facing real life investors who must be concerned with 5, 10, 15 and 20 year time frames from today.

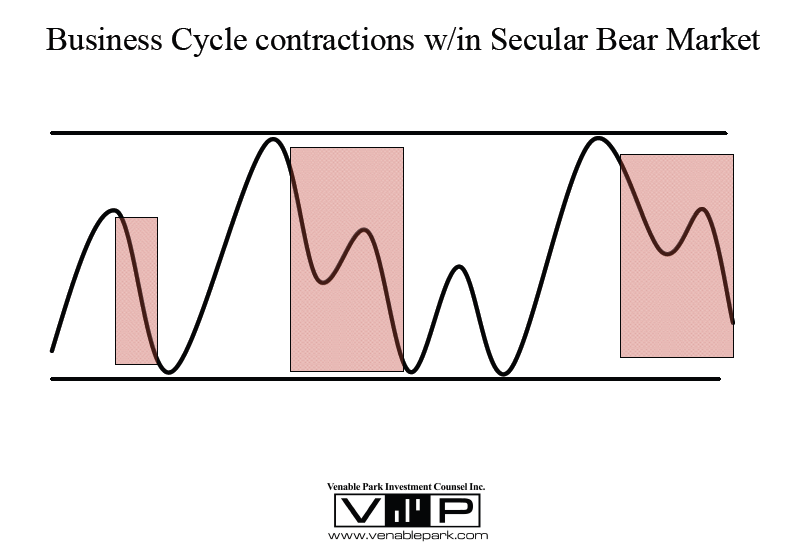

Secular bear periods like the one stocks have been working through since 2000 start from periods of extreme over-valutaion. Over 17 to 20 years they move through a series of heart-thumping gyrations of up and then down cycles, up and then down cycles–moving between prior cycle highs and prior cycle lows. In the end through the healing of time, these cycles finally compress excessively high valuations back down to once-in-20-year investment opportunities by the secular bear end.

Today, just over 5 years since the last uber-optimistic peak in 2007, we find stock valuations once more at extreme over-valuations for the 3rd time in the past 15 years. In the wake of financially suicidal central bank intervention, this up-cycle has no doubt been extended (just as sub-prime securitization extended the 2003-2007 up cycle to an equally incredible peak and unforgiving crash). But history promises anyone who will heed it that the most probable path ahead is a trip back to retest prior cycles lows (to wit 2003 and 2009) at least one more time ahead in the not too distant future.

And here is the rub: it is the down cycles that dictate the reward or lack there of for the entire round trip. An investor (or a fund like the CPP) can make double digit returns every year for 4 and 5 years, and then lose all or nearly all of the benefit of those gains in just the one or two down-years that comes in each market cycle. After huge stock returns in the later 90’s, the 2001-2002 bear market took back all of the gains earned by stocks above T-bills since 1996. After huge gains again in 2003, 2004, 2005, 2006, 2007, the bear market of 2008-09 took back all of the cycle gains made over the preceding 12 years, all the way back to 1995!

In other words, one could have missed out on 15 years of stock investing from 1996 all the way through early 2009 and made more net gains sitting in cash equivalents than riding the secular roller coaster of risk. For individuals this reality is even more acute than for pensions. Because individuals are highly vulnerable to the market cycles that impact our life savings over 5 to 20 years. We do not have endless cycles to make up for lost gains and we rarely possess the emotional stamina to sit patiently through horrific down cycles without jumping out near bottoms and doing permanent harm. This means that in real life, people fare far worse than market returns suggest.

As boring as it may sound, the truth about real life investing is that 2.4% a year earned over 5 years on a wild stock market ride that looks like the below chart, is much less valuable–much more full of personal risk– than 2.4% a year earned slowly but gradually in cash like deposits.

For those who are taking a victory lap today because they have just recently managed to make back some of their losses for the third time in the past 15 years–the truth is that they have not done well. Nor have they been adequately rewarded for incredible capital and personal risks taken. In secular bears, egos and intellect aside, less risk ends up being more–more money and more peace of mind.