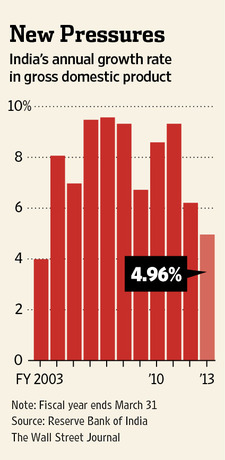

The US dollar consolidated some gains last week, but year to date the greenback has been climbing against nearly every major currency in the world. Since commodities like oil are priced in U$, the climbing dollar translates into increased cost pressure on many of the world’s already struggling economies. This morning the Indian Rupee(INR) hit an all time record low against the U$. The 10th largest economy by nominal GDP and the 3rd largest by purchasing power parity (PPP), India like most countries has been facing significantly slower growth and demand since the global credit bubble burst.

A weakening Rupee helps to make Indian exports cheaper, but for a country that imports 80% of its oil, the retreat of the Rupee also leaves less room for monetary easing as inflationary pressures build amid weak domestic fundamentals. (Same negative cost effect for Japan on weaker Yen: see video report here).

Furthermore, the US Fed’s Quantitative Easing has driven speculative money flows into most emerging economies, markets and currencies over the past 3 years, and the inevitable ‘tapering’ or dreaded reverse of those flows poses a significant price risk to Indian capital markets which have been weakening now since 2011. See: Rupee’s slide to record drags down bonds, most Indian stocks.