‘QE’ experiments have birthed the latest in a recurring saga of group faith in fairies. After 3 years of intermittent liquidity spikes that had, at least to the end of May, managed to stall the S&P from joining commodities and emerging markets in a global cyclical bear market since 2011, a consensus view today is that US stocks can only continue to rise decoupled from the rest. At 6 year price highs, most today see no reason for downside concern. This simple assertion so widely mouthed gives the contrarian in us strength to stick math and hold our discipline. We must be getting old, for we have seen this movie so many times over the years:

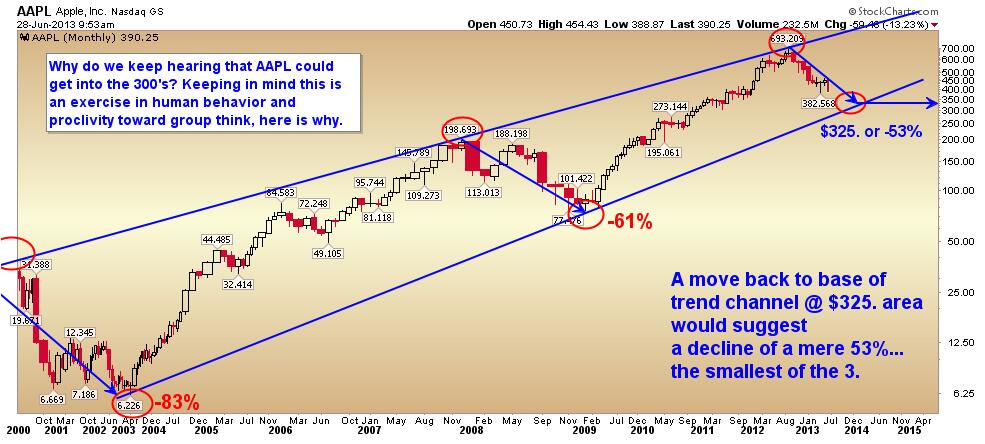

The consensus always expects recent trends into perpetuity. This is what brings meaningful opportunities near bottoms for those who can resist the seduction of the masses near tops. Whether it be tech stocks, housing, commodities, emerging markets, Facebook, precious metals or QE’ternity, the more the story or ‘hot’ theme changes, the more outcomes stay the same. This long term chart of Apple is one of hundreds of perfect examples. Everyone is most optimistic and clamouring to enter near the top end of price channels. After drops to the bottom end, the same crowd is selling or changing their views in disgust or dishonour–on to the next theme, without adjusting or improving behaviour. And so the cycle of suffering goes…

Going against the consensus view can be lonely and uncomfortable at times, and yet, when it comes to preserving and growing capital over a full market cycle, doing so is simply imperative.