Equity analysts are perpetually bullish–except at the bottom of recessions where they notoriously capitulate to the recency effect and forecast a continuing plunge in earnings just as sales turn up. As a result, equity analysts are as utterly useless as mainstream economists (also incapable of forecasting recessions) in helping anyone anticipate market cycles.

As companies have repeatedly lowered their revenue and earnings guidance over the past 2 years, analysts have lowered their expectations in lock step. Today this trend continues, with companies issuing negative revisions at a record 6.5:1 compared with any positive revisions. The story of economic bell weather Alcoa reveals a typical pattern over the past 2 years: in January 2012 management (and therefore analysts) were forecasting Q2 2013 earnings per share of 7.20, which was ratcheted down month after month and quarter after quarter to just .06 a share by June 2013. This ensured that Alcoa could then “beat” earnings by announcing Q2 earnings this week of .07 a share (a beat! but 99% lower than had been expected 2 years ago). Global GDP forecasts have been following a similar staircase down over the past 2 years even as US stock markets have run wild on QEphoria.

This video report offers some reality check for those that like facts: Earnings growth target dips to 2.9%-Thomson Reuters Harrison. Here is a direct video link.

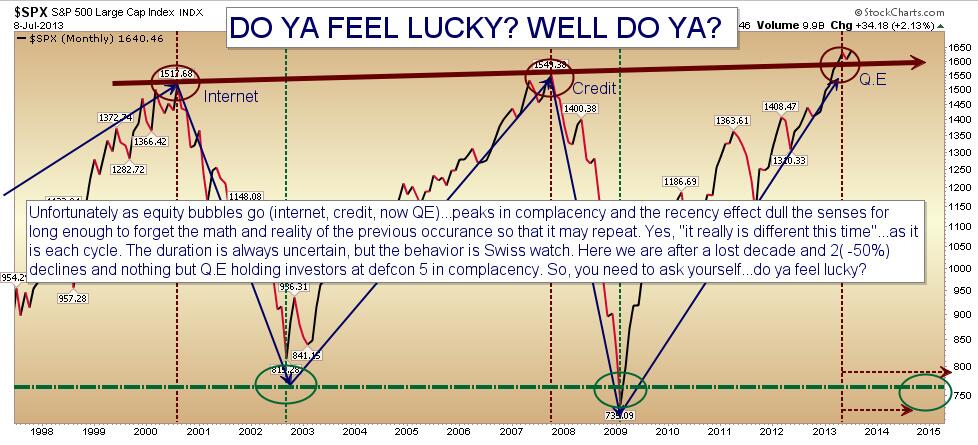

For those who prefer fantasy and gambling on increasingly horrible odds. The S&P 500 is looking fantastic at present levels.

Chart source: Cory Venable, CMT, Venable Park Investment Counsel Inc.