This morning Asian stock markets staged a relief rally of sorts apparently on news that the Chinese economy (the world’s 2nd largest) expanded at an official annualized rate of 7.5% in the second quarter. This number although higher than some had estimated, is lower than Q1 and continues the downtrend in Chinese growth that has been underway since it peaked there at an annualized 14% in 2007 (thanks to western demand courtesy of the credit bubble).

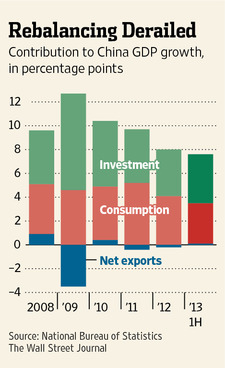

Now Chinese Premier Li is promising to shift the economy away from the old investment-led model to one focused on domestic consumption. This is a valid long-term goal, but far from present reality where despite wage gains in recent years, Chinese consumer consumption has been falling, fueling less GDP growth every year since 2008. See: China is slow and unbalanced

Now Chinese Premier Li is promising to shift the economy away from the old investment-led model to one focused on domestic consumption. This is a valid long-term goal, but far from present reality where despite wage gains in recent years, Chinese consumer consumption has been falling, fueling less GDP growth every year since 2008. See: China is slow and unbalanced

With lower government investment and markedly lower exports, it is more than suspicious that Chinese GDP continues to hold above the government’s “official target” of 7.5%.

Gary Shilling points out the wonder of the China growth miracle well in his July subscription letter this month:

“…in China, GDP numbers are released 18 days after the close of the quarter in question, even though some locations there are only accessible by ox cart and then only in dry weather. And since they always get them right the first time, Chinese numbers are never revised. In the U.S., with all our sophisticated data collection, it takes 28 days to compile and release GDP estimates, and they are revised continually as more data becomes available.”

Observable objective data like energy consumption, and import and inventory data suggest that the Chinese economy is actually growing somewhere closer to the dread 5-6% hard landing area where growth is insufficient to maintain stability in the domestic economy and presents a major drag on global growth. Meanwhile with a major miss in US retail sales this morning, the US economy is now tracking in the perilously slow -.2 to .6 range for Q2 GDP. But then, with Central Banker worship so widely prevalent at the moment, surely US stock markets will be able to keep whistling past the graveyard of a contracting global economy indefinitely. Right? This global recession will be different than all the rest, right?